“Davidson” submits:

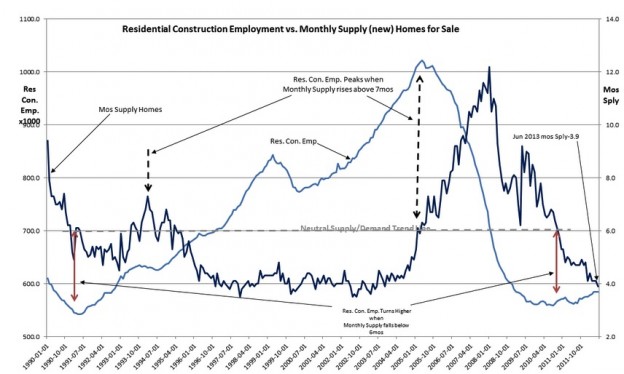

The Monthly Supply of New Homes for Sale was reported at 3.9mos ($XHB). This represents relatively strong Demand vs. Supply and at under 4.mos this number is at the level equaling the strongest housing market in the past ~25yrs. Monthly Supply at this level has always been good for a higher Residential Construction Employment trend. Strong economic demand is what drives housing and markets.

The Mtg Bankers Assoc did a study which showed a 7-8x multiple impact of Residential Construction Employment in the rest of the economy. One can estimate that Residential Construction Employment should rise by 500,000+ the next 4-5yrs to return to previous levels. This would translate into 3.5-4mil additional jobs throughout our economy for a total of 4-4.5mil new jobs in a Single-Family Housing market at full recovery. As noted many times, this is not a dramatically rapid process, but one which develops over years.

This time around the impact of the Fed keeping longer term rates down by conducting QE2 and QE3 have stifled normal bank lending as low mtg rates prevent banks from having the normal lending spreads required to offset the risks associated with lending to individuals with FICO scores less than 760 ($XLF). But, investors have adjusted recently having failed to have their portfolios benefit from a collapse in the US$ and rapid rise in inflation, gold, oil and etc., we now see funds moving into equities and away from commodities and fixed income. Yes, the US$ remains relatively strong and inflation continues to fall. As investors shift portfolios to capture the strong uptrend apparent in equities they cause rates to rise, bank spreads to widen and mtg lending to accelerate. I encourage investors to think of this as the normal progression of economic expansion.

As investors shift portfolios to capture the strong uptrend apparent in equities they cause 1)-rates to rise 2)-bank spreads to widen and 3)-mtg lending to accelerate.

This is all good for higher economic activity and higher equity prices in the months ahead ($SPY). I remain quite positive and estimate that we should experience a general rise in equity prices lasting ~5yrs. The better asset classes at this point in the investment cycle are in my opinion US&Intl LgCap with smaller positions in SmCap and Natural Resources. I do not recommend EmgMkt, REITs or Fixed Income exposure but for special situations