‘Davidson” submits:

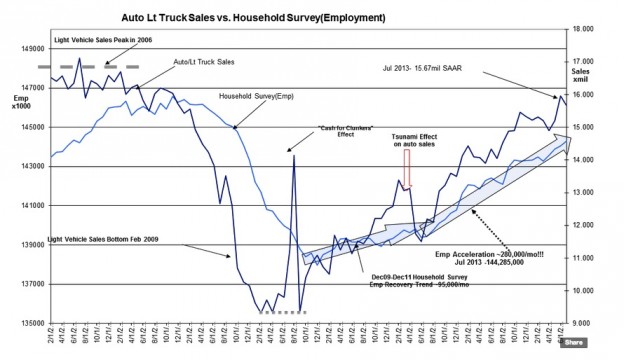

Light Weight Vehicle Sales for June 2013 came in at an estimated at 15.67mil SAAR (Seasonally Adjusted Annual Rate) with the Establishment Survey reporting 161,000 new jobs added and the Household Survey which captures the self-employed reporting 227,000 new jobs. The Unemployment Rate which comes from the Household Survey has fallen to 7.4%. The BLS press release is available here: BLS Employment SituationIn the chart below I show the trends of Auto Lt Truck Sales vs. Household Survey(Employment). Both, the vehicle sales pace and the pace of hiring in the general economy are tracking their corresponding existing trends. The media’s discussion that these numbers are “crappy” are really without merit. These are good numbers and good for equities long term.I continue to reiterate my almost boring mantra, “Buy”!!

The US represents 310,000,000 creative people seeking to improve their own and their family’s standard of living. We operate in a more and sometimes less “Free Market”. Economic data simply represents this effort in all its manifestations. Many times in our past, government has sought to impose social directions. These often well-meaning efforts have at times resulted in significant financial imbalances. If government gets something right, history reveals that it was more often than not thru non-directed government spending.

The basic issue is that politicians and politically appointed administrators carry the belief they know better how the “People” should spend their capital and impose directions on capital spending rather than leaving it to individuals to act within a simplified regulatory system founded on “Treat thy neighbor as you treat yourself”. In the process government has periodically imposed regulation which has destabilized our financial system. There have been three major destabilizations in our history which have come from misguided government “do-gooding”.

1) The Great Depression…followed by a Great Recovery

2) The Great Society…followed by a Great Recovery

3) The Great Recession…followed by a Great Recovery(we are in this recovery today)

It is the desire of individuals to advance themselves and their families which have always brought us out of these self-imposed disasters. I contend that it is individuals who act with a natural sense of the “Golden Rule” who bring us out of financial disasters. The so called “Golden Rule” is not an imposed religious rule, but one which comes from thousands of generations of human beings working successfully together in social structures designed for joint survival. We carry within each of us a series of natural instincts for survival.

We each have a desire to succeed and a desire for gaining the esteem of our peers. This is likely part of our genetic make-up. It is basically: work hard, develop a useful skill set and exchange one’s skill set with other’s for goods and services one cannot do for one’s self. This inner drive is what makes our economy and our society thrive. Rules of law which encourage this expression is generally what we have in the US. Sometimes. those in government lose track of trusting individual common sense and impose their own version of “Father Knows Best”. I encourage all to read The Law by Frederic Bastiat (written in 1850). Bastiat defines the purpose, value and the use of law in a refreshingly simple thesis. Amazon offers this short and very succinct explanation of what the law should and should not do for a paltry $5.32.

What is present in our current economic data is a recovery from one of the great self-imposed financial disasters in our history. Not only have we always recovered, we are recovering at the moment! It is my estimate that we still have ~5yrs till our economy runs into a period of economic excess. The equity markets historically rise into the peak of economic activity. Till then, one does best by being positive on equities and negative on fixed income.

I remain quite positive on equities. I recommend Intl and Domestic LgCap, SmCap and Natural Resource Equities and recommend the avoidance of EmgMkts, Fixed Income generally (as rates rise) and REITs