“Davidson” submits:

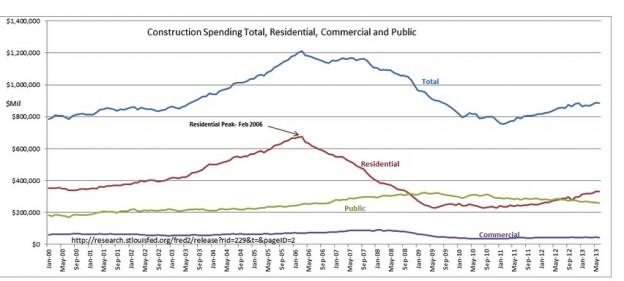

The two chart below, Construction Spending Total, Residential, Commercial and Public, reflect significant improvements our economy. They have been slow in finding and moving off their lows, but they are certainly developing uptrends today. Construction is a huge jobs multiplier as the number of individuals hired in direct construction activity impacts multiple related goods and service sectors. A study by the Mtg Bankers Assoc estimated that each Residential Construction hire resulted in 7-8 additional hires in related areas of the economy, i.e. mining, lumber, real estate brokers, attorneys, furniture and appliance mfg and retail and etc. Today each home carries an avg. $260,000 price tag. This is more often than not a levered purchase, using the mtg markets. Banks ($XLF) cannot lend if both short and long rates are so low that lending spreads do cover expenses and potential default risk. BUT, as rates rise in the beginning of a cycle, the long rates rise faster than the short term rates and bank lending spreads improve. Bank lending activity picks up early in the real estate cycle. It is only as the real estate markets mature, when rising short term rates vs. long term rates cause lending spreads to narrow, that bank lending spreads no longer cover expenses and default risk and lending activity slows.

The Construction Spending Total, Residential, Commercial and Public chart is an estimate of the TTM monthly(Trailing Twelve Months) spend, i.e. at the peak in Feb 2006 just over $1,200,000 million was spent on Total Construction Spending. This represented 8.6% of the $13.8Trillion in GDP reported for the 1Q2006.

1) Peak TTM monthly Total Construction Spend in the last cycle occurred February 2006 at $1.2 Trillion!!

2) Residential Construction spending at the peak was ~55.5% of the total.

3) Residential Construction is leading Total Construction Spending in the current cycle.

4) Commercial Construction is flat.

5) Public Construction, i.e. spending on highways, public projects has been down since Jan 2009-Government spending has been flat for several years(see email sent several weeks ago)

The Jun 2013 ABI chart reflects increasing activity for architectural design services with all sectors of the economy showing improvement (see post here). In particular the demand for Residential design services has been the strongest sector having been consistently above 50 since June 2012. Lately, the demand for Institutional and Commercial design services are picking up. All regions of the country are participating with a typical weather pattern connected level of activity, i.e. stronger in the South, Mid-West initially stronger, but suffering from difficult weather conditions in May 2013 but now in an apparent rebound.

Residential Housing activity has a significant impact on our economy. All indicators show continued improvement and recent ABI Inquiries forecast higher Total Construction Spending in future months. I expect to see significant improvements in Construction Employment in the coming months, accelerated economic activity and higher equity prices.

The trends in construction spending indicate a good period for equity investors. One can estimate that markets still have 5yrs-6yrs of equity price increases all things being equal