Following up on my post yesterday regarding the housing data, Davidson chimed in today on it

“Davison” submits:

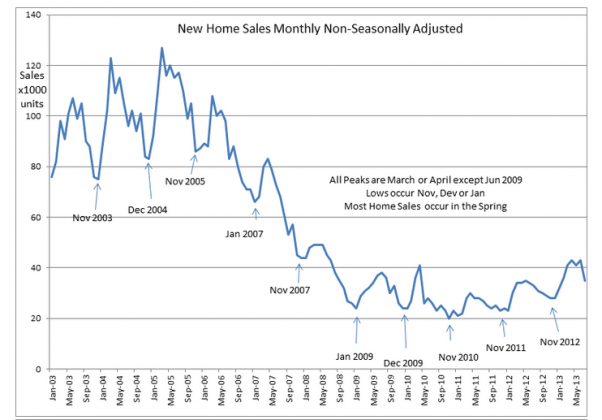

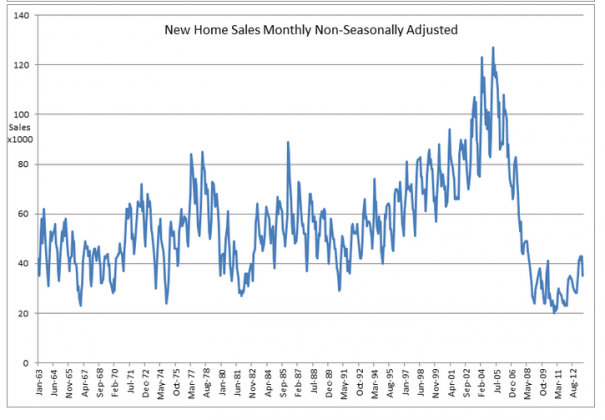

New Single Family Home Sales were reported as 13.4% lower, much lower than expected. Like a line of dominos dropping one after the other, the forecasts for a slowing economy and talk of a pending housing recession were nearly the only opinion one could hear ($XHB). Talk of the market as over-valued permeated the media! The market ”…has been manipulated higher by the Fed”, and “…there is no reason for the market to be this high!” are some of the many statements I heard. The problem with these fears is that the actual data does not lead to a conclusion anywhere near this conclusion. See the charts below New Home Sales Monthly Non-Seasonally Adjusted-the 1st from Jan 2003-Jul 2013 and the 2nd from Jan 1963 to Jul 2013(entire history of this data series) Both can be found at the St Louis Fed link: http://research.stlouisfed.org/

The actual data which is non-seasonally adjusted has a definite seasonal pattern. Ask any real estate broker, sales are much stronger in the Spring than any other part of the year. The data reflect this as can be seen in the 1st chart. All sales peaks in the Jan 2003-July 2013 period occur in March or April but for one peak occurring in June 2009. Sales lows occur during the “holiday months” of November, December and January. This is a pattern which has been in place as far back as we have data reflecting long established patterns in society. We do not want to move during the winter months and we like to be settled in a new home in time for the school year and the yearend holidays of Thanksgiving, Christmas, Hanukkah and etc. The 1stchart shows this pattern clearly. The 2nd chart shows that this seasonal pattern has always been present in this data.

In the current cycle, sales peaked in April at 43,000 and hit 43,000 again in July before the seasonal dip began. Rather than wring our hands and quiver in fear we should interpret a double-peak as an unusual show of home buying strength. This is the type of pattern which occurs during strong real estate cycles with peak sales pace extending into early summer. Contrary to the interpretation presented in the media, today’s new home sales present a strong pattern and not one which is weak.

Gaining an edge over average market returns requires seeing the data differently than how it is generally interpreted. This means that one must be able to parse the data in all its detail, connect it to what we as human beings are actually doing, have acted in past cycles and determine its impact within the broader economic and investment market context. Those who see the data in detail for what it is have an advantage over those who do not understand its nuances. Successful investing comes from separating the truth from the myth and investors who do so stand apart from common thinking. Often it is the contrarian investor who is the most successful. But, one must not just be contrarian for contrarian sake! One must only take a contrarian stance because the data analyzed carefully away from the heat of the moment justifies.

The current home sales data justifies being optimistic towards stocks and pessimist towards bonds. In my opinion we are seeing the signs of a stronger than average housing market which is still early in its cycle.