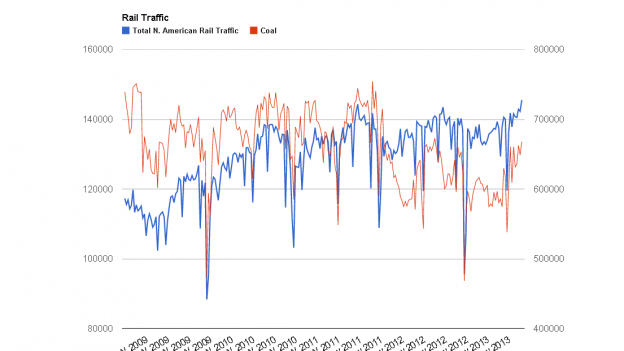

Total N. American rail traffic jumped to 727k carloads last week, the strongest reading in the 5 years I have been tracking the series. This is significant as the steady and increasing rise in traffic signals not only a stable economy but one that seems to be accelerating. When you couple this data with recent auto and housing data, you have a recipe for increasing GDP growth for Q4.

Again, to those doubting the recovery and rail traffic strength, they will claim that it is solely due to increase in oil shipments.

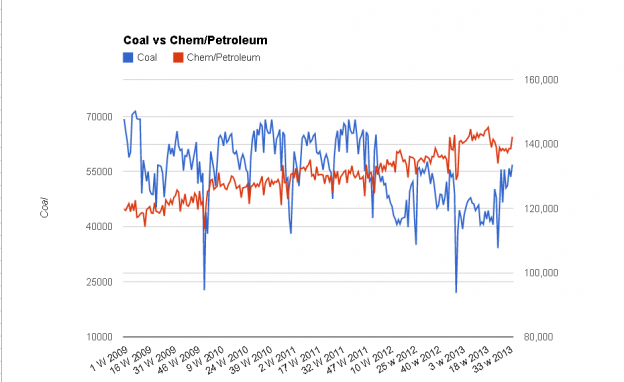

While chemical/petroleum shipments have increased ~5k-10k carloads/wk since 2011, coal traffic has decreased ~10k-20k carloads/wk (due to increase use of natural gas shipped by pipeline). So all that chemical/petroleum increases (note all of the increase is not solely due to oil) have done is helped to offset to larger decline in coal. In the current record week, coal shipments were down 16k vs the previous weekly high set late in 2011 and petroleum/chemicals are only up 10k vs ’11 for a net 6k decline in total traffic due to the fracking/Bakken effects. This means the surge in traffic is NOT due to Bakken oil but to underlying economic strength.

In fact the largest YOY increase vs the previous record week in 2011 are in autos, stone and related products (think construction) , forest products (think housing) and intermodal traffic. All of these point directly to increases manufacturing, construction and retail. This increasing activity will lead to higher equity prices in the future ($SPY).

As always the disclaimer that one weeks data does not a definitive judgment make. One must continually follow the series to ensure the trend remains in tact that one weeks strength (or weakness) is not simply reversed in the following week. All that said, it is hard to deny that based on the metrics I follow the overall economy is not accelerating at what seems to be an increasing rate.