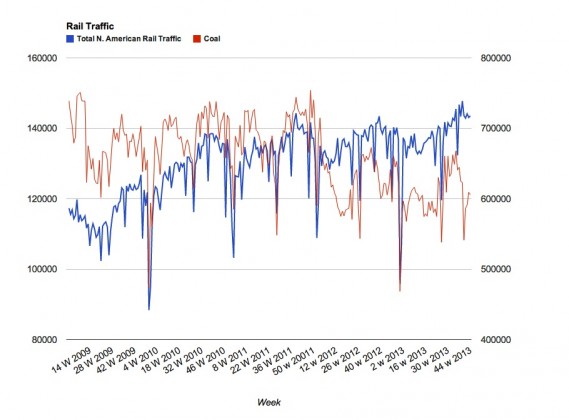

Long time readers know this is a favorite of all the indicators we follow. Total N. American rail traffic came in at 717k carloads last week, well above 2012 levels. Of more importance, was the categories that continue to hove at or above multi year highs: forrest products, metals, autos and stone & related products. Those are the core building products used for all types of construction and manufacturing. Seeing them show continued strength (both coal and petroleum were down) long with intermodal traffic indicates continuing growth in the US construction/manufacturing sector.

Here is the chart:

When we add to this the multi-year breakout in temporary employment (see below) we can add a strengthening labor market to the mix:

When we add to this the multi-year breakout in temporary employment (see below) we can add a strengthening labor market to the mix:

Those who have followed these indicators should not be surprised by the 2.8% GDP reading we saw today and in fact, were it not for the gov’t shutdown in Q4, I would day we would have surpassed that. I have no prediction on what effect the shutdown will have on Q4 GDP. There could be catchup activity over the remaining 7 weeks of the quarter that could negated its effect. We will probably never know although I’m sure politicians will try to place a number on it so as the castigate the other party for the shutdown.

Ignore them. As we have seen despite sequester, the EU, budget battles, the US economy is gaining steam, not losing it. All the main data point we follow here back that thesis. Imagine what it could do if the the gov’t ever got its collective act together and stopped with the “quarterly crisis” garbage? If we had anything representing a cohesive economic and tax policy? If business could plan more than 6 months ahead?

The fact the economy is doing what is has despite the US Gov’t doing just about everything it can to derail it is a testament to its underlying strength. The point of this is not to bitch (ok , just a little) but to say that if Congress and the Pres make any progress at all (coin flip), we could easily see growth >3% next year…