We here turned positive on housing back in mid 2011 and remain so today. Yet every weekly and monthly housing number (as if a housing trend can be extrapolated from a single data point) is scrutinized so we can be sure to see what is wrong with it. It is easy to see why people still do not believe both the economy and housing are in full recovery. We get a constant barrage of negativity from all of our news sources (both financial and network/cable news) as well as the constant near calamitous action from Congress and the President. Our current Congress is so dysfunctional that I long for past dysfunctional Congresses.

For all of their animosity, the Clinton/Gringich Congress worked together in a way that makes the current relationship look slightly less antagonistic than Israeli/Palestinian relations. No, you can’t blame a single party here, neither are doing anything to better the situation. The President seems to not realize he was “elected” by just over 50% of the voters and not “anointed” by all of them. From the other side of the aisle the GOP should recognize that simply saying “No” to everything the other side proposes isn’t really a strategy or a plan.

So, with all that one truly can see why American’s aren’t really seeing the true picture out there (see below). Yet, both housing and the economy still chug along. This is where doubters will chime in and claim “it is only because of the Fed”… I will note that those folks by in large will also say “the Fed policy has failed because it has not stimulated the economy” …..um, you can’t have it both ways. The Fed has been around for near a century now, any recovery in the past has had some Fed tinkering involved with it……that does not mean it did not happen.

Here is the thing, the economy will continue to chug along even when people are pessimistic. But, can you just imagine what will happen as they turn optimistic? Eventually the pendulum always swings the other way….

“Davidson” submits:

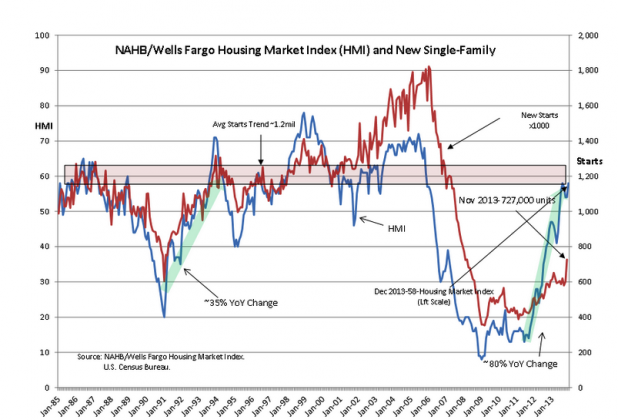

Late today the Commerce Dept released the New Single-Family Starts data which had been backlogged due to the government this past October. It is shown as usual in comparison to the Natl Assoc of Home Builder’s HMI(Housing Market Index). As you can see, the earlier rise in the HMI forecasted a rise in New Single-Family Starts. The relationship is not in lock-step, but a general rise in New Single-Family Starts always follows a rise in the HMI ($XHB).

Home Builders see the demand trend for New Single-Family Homes in real time as buyers make the decisions. A rise in the HMI is one of the more useful guides to future employment trends because of the 7-8x multiplier that hiring in Residential Construction has on the rest of the economy.

Only recently has it been noted in the press that the housing industry is recovering. BUT, the HMI alerted us to the recovery more than 2yrs ago and knowing this has been very helpful in guiding our commitment to equities. The next housing report to watch is the Monthly Supply of (New) Homes for Sale which should be out next week.

I believe that, in spite of the media focus that higher mortgage rates at this point in the economic cycle will cause a slide into recession, the opposite will occur. As noted in earlier commentaries, higher rates for long dated bonds, i.e. 10yr Treasuries, provide wider credit spreads to banks which encourages lending. This is the pattern of past recoveries. In my opinion this is the reason for the nearly 300 point rise in the Dow Jones Average yesterday. By the way, Lennar ($LEN) reported much better than expected earnings and revenue today!!

How does one compare this New Single-Family Starts report, the higher HMI, the record Industrial Production, the record Personal Income, the record Retail and Food Service Sales, the near record Light Vehicle Sales and etc. with the Washington Post poll which reported that 79% of the country believes that we remain in a recession? Link to Washington Post poll: Washington Post 79% Believe Still In Recession

Many find it difficult to decide whether to believe the numbers or what is being said in the general population, i.e. what is said in the media. It seems politically correct to be a pessimist these days.

Those who can separate what is factual from what is a virtual ‘open firehose’ of information thrown at us each day are the better investors. They make measured investment decisions based on facts and the relationships between facts which are known to hold over the long term These investors not impulsive! They do not invest on whims! They do not invest with the crowd!

Those who weigh the facts do not believe we are in recession today. Those who weigh the facts have watched the economy rise out of recession beginning early 2009. Those who weigh the facts already have some nice gains, but know that more are likely the next 5yrs ($SPY).

Facts like the HMI and the New Single-Family Starts data are very helpful in keeping our investment judgment on the right track while 79% are still worried about the impact of recession. Facts are why we can be optimistic and why we can believe that being optimistic at this time is warranted