Longtime readers know I follow two primary indicators when looking at the macro picture, temp help and rail traffic. If these are trending positive, then all other indicators will trend the same way. Additionally, unlike all the weekly/monthly indicators, they are not prone to large revisions that make the primary number released virtually useless as an indicator of anything.

Now, my first thought when I considered this was that the chemical usage would be mainly depicted in the rail data but truckr are still the main mode of transportation for chemicals (link here, data updated 2010). So, it seems my rail traffic is not fully capturing that rather large slice of the economy so vital to foretelling its growth or contraction.

I’m gonna watch this for a while longer but I think it is going to make the list…

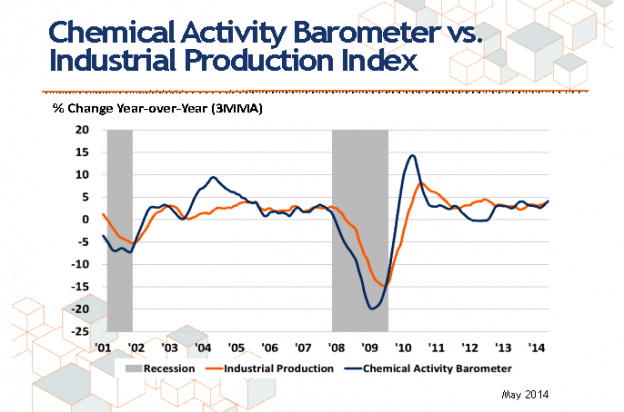

WASHINGTON (May 27, 2014) – The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), has reached its highest peak since February 2008, while also posting its highest year over year gain since September 2010. Measured on a three-month moving average (3MMA), the CAB realized a healthy 0.8 percent gain over April, and is up a solid 4.1 percent over this time last year. The data reflect upward revisions for the previous five months, suggesting more than just a rebound from the adverse winter months.

“The index reveals that the underlying fundamentals are good,” said Dr. Kevin Swift, chief economist at ACC. “Based on weekly data, production-related indicators showed healthy growth in May, beating the average 0.3 percent gain in the first quarter,” he added.

Though housing starts improved last month and sales of existing and new homes were up, activity within the construction-related plastic resins segment was mixed. In contrast, activity within the pigments and other performance chemistry markets, such as adhesives, sealants, and paint additives was stronger. Likewise, upward performance within the electronics chemicals sector was encouraging as the semiconductor industry is a bellwether of the industrial cycle. Furthermore, gains in oilfield chemicals suggest that the boom in unconventional oil and gas continues to progress, enhancing overall economic growth.

The Chemical Activity Barometer has four primary components, each consisting of a variety of indicators: 1) production; 2) equity prices; 3) product prices; and 4) inventories and other indicators. Overall results in the four primary components of the CAB were positive, with chemical equity prices continuing to outpace the broader market.

The Chemical Activity Barometer is a leading economic indicator derived from a composite index of chemical industry activity. The chemical industry has been found to consistently lead the U.S. economy’s business cycle given its early position in the supply chain, and this barometer can be used to determine turning points and likely trends in the wider economy. Month-to-month movements can be volatile so a three-month moving average of the barometer is provided. This provides a more consistent and illustrative picture of national economic trends.

Applying the CAB back to 1919, it has been shown to provide a longer lead (or perform better) than the National Bureau of Economic Research, by two to 14 months, with an average lead of eight months at cycle peaks. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2007 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.