“Davidson” submits:

Fear of rising rates…….It is what they miss which is important to us!

Many fear that the economy can turn on the head of a pin. They believe every turn in markets reflect economics and that one month’s economic report is a forecast for the next 12mos. Many have stated that there is no basis for the stock markets being higher the past 5yrs except for the Fed keeping rates low. They do not see what we see!

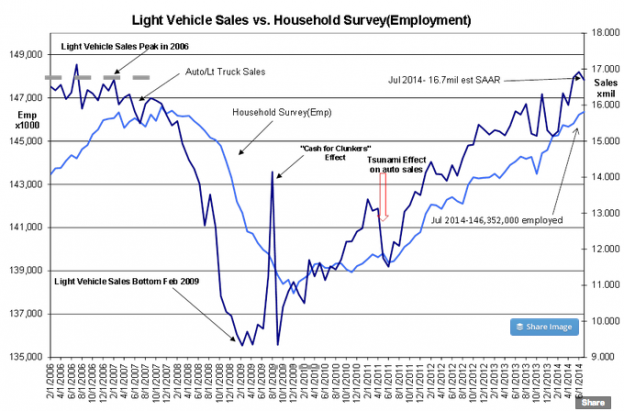

The data which correlates most closely to stock markets is Light Vehicle Sales. Today’s Household Survey(Employment) and Light Vehicle Sales reports came out this morning. The chart below shows where they have come from since 2009. Light Vehicle Sales and Employment are highly correlated over a cycle. This is real economic growth and not a figment of the Federal Reserve keeping rates low.

That there is true growth in Real Personal Income is shown in the next chart hitting record levels. This is real economic growth and not a figment of the Federal Reserve keeping rates low.

That there is true growth in the Real Retail and Food Service Sales is shown in the bottom chart hitting record levels. This is real economic growth and not a figment of the Federal Reserve keeping rates low.

Today’s employment report is on top of 15,000 more employees from revisions to previous months. Upward revisions have been the trend for sometime. Yet, many just do not seem to get it. This is good for those who are invested as market psychology still has some way to catch up as it typically does at market peaks. We can in my opinion expect a considerable push higher in equity markets as more and more investors are forced to accept the economic improvement which has been in place since 2009. Many remain on the sidelines and when they reenter the equity markets, equity markets can only rise higher.

As market psychology improves, we can expect higher rates as investors shift from Fixed Income to Equities. We may just be seeing some of this the past couple of days. 10yr Treasury rates have been kept low first by the Fed in a misperceived effort to stimulate mortgage lending(this has been an unmitigated disaster) and more recently as the US has been flooded by foreign money seeking safe havens in real estate and US Treasury debt. Russia’s attacks on Ukraine has caused an additional influx of foreign capital to the US. Bank lending has been tight because spreads between their cost of funds and lending rates have been too narrow to justify lending in the tighter regulatory climate. Higher 10yr Treasury rates will widen lending spreads, expand bank profits/lending and spur the economy, especially Residential Construction.

Expanded bank lending is very likely to bring Construction Employment higher by 2mil. With the 7x multiplier the Mtg Bankers Assoc claims reverberates throughout the rest of the economy for each construction job, we may see an additional 14mil added to the employment rolls the next few years.

I remain positive on equity markets as long as employment trends continue higher. Markets are made by economic activity and not the other way around. All economic trends look very positive