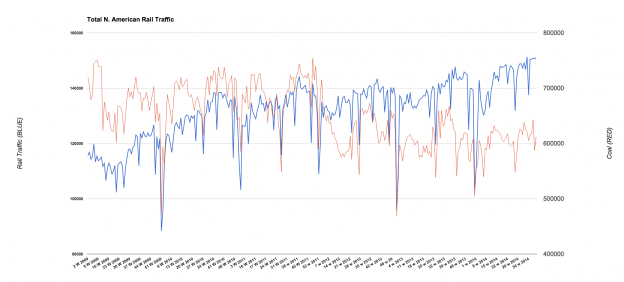

Total N. American rail traffic came in at 755k carloads last week coming within 800 carloads of eclipsing the record set just 6 weeks ago. It ought to easily eclipse it in the next couple weeks.

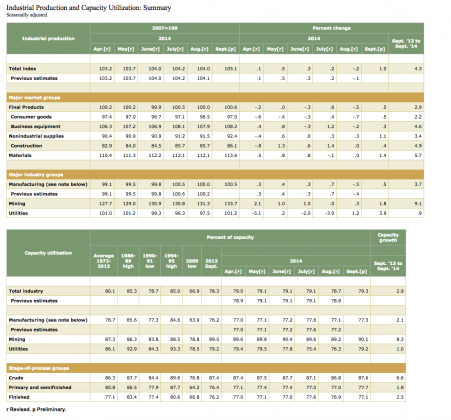

When one also looks at industrial production and first time claim numbers out today, the inescapable fact is the economy continues to improve. Industrial production saw improvements in every category for Sept :

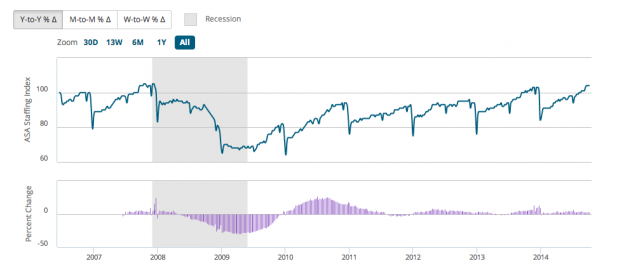

Unemployment claims are back to 2000 levels:

In the week ending October 11, the advance figure for seasonally adjusted initial claims was 264,000, a decrease of 23,000 from the previous week’s unrevised level of 287,000. This is the lowest level for initial claims since April 15, 2000 when it was 259,000. The 4-week moving average was 283,500, a decrease of 4,250 from the previous week’s unrevised average of 287,750. This is the lowest level for this average since June 10, 2000 when it was 283,500

If we add in Temp Employment, a harbinger of what is going to happen with NFP in about 3-4 months, we see that index continuing to climb higher and in fact just 1 point below an all time high set in 2007:

This index typically does not peak until the end of November into December so we can expect the all time record to easily be passed and this years holiday number to be significantly higher than last years.

In fact all four data series have been in a prolonged uptrend this year giving even more credence that the economy is indeed strengthening.

So, what to think about this selloff? Ebola? ISIS? Russia? Iran? Oil? Dollar? Who knows, these things happen every so often and people spend an inordinate amount of time figuring out the “why” of it.

It could be any of the above or a combination of some or all of them. One thing it isn’t is a slowdown in the US economy. In fact the collapse in oil and the corresponding reduction is prices at the pump going into the Christmas season is extremely bullish for the US consumer and thus Q4. In fact the ~$.20 fall in US gas prices over the last month or so equates to ~$20B more dollars in US consumers pockets this fall…… that is substantial (it is ~$1B for every $.01 move in gas prices). This also fails to take into account the fall in diesel prices that will reduce shipping costs across the US also.

The economic data by no means justifies what we’ve seen in the market recently……