“Davidson” submits:

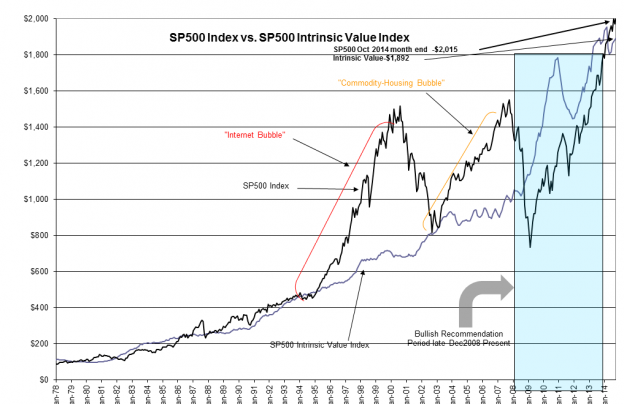

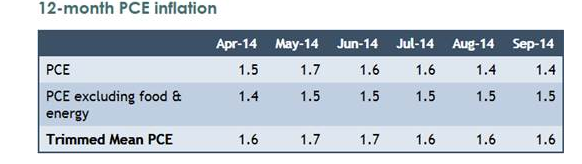

The Dallas Fed reported Sept 2014 12mo Trimmed Mean PCE at 1.6% and revised down July and August from 1.7% to 1.6%. This cause a rise in the SP500 Intrinsic Value Index to $1,892. Over the long term, the SP500 ($SPY) Intrinsic Value Index is the level which brings in Value Investors such as Warren Buffett. Today the SP500 rebounded from recent lows at $1,835 to over $2,015.

http://www.dallasfed.org/research/pce/index.cfm

Investors should not try to locate precise pricing reasoning in the SP500 Intrinsic Value Index. It is simply a rough level for Value Investor buying over longer periods which helps to identify periods where equity pricing offers attractive entry points if one knows how to identify value. Most professional investors do not know how to do this(in my opinion) and simply follow market momentum. This is the reason for the periods of wild volatility we see so often. Rather than having a fundamental valuation approach which lets one measure business returns and prices separately, many investors let market behavior be their primary investment input and are ‘Bullish’ and ‘Bearish’ accordingly hoping to trade ahead of ‘the other guy’. This is why investors seek high speed computers and low commissions as the solutions the only solutions to improving returns.

Stay the course. Add to equity positions. Trends continue to suggest a 5yr-7yr rise in equities driven by improving economics.