Since I don’t watch the TV I missed this exchange this morning……

“Davidson” submits:

We are now 4 ½ yrs into economic recovery. Well known market commentators, like one on CNBC this morning, continue to say that the ‘economy is awful’ and all the job growth is low quality with no wage gains, ‘no increase in personal income’ and ‘poor retail sales’. Perhaps you listened to the same interview this morning. The commentary dominated 8AM-8:15AM discussion and the opposing view was put down as ‘talking your book’. Hmmm…? It is no wonder that investors have such a difficult time coming to terms with all the financial information and conflicting points of view.

In my opinion, the only way investors learn to ‘thread the needle’ through the massive swirl of crosscurrents is to separate out the factual from the imagined. There is in fact a broad spectrum of individuals who ‘talk their book’ in the media. It is called marketing! In the world of Wall Street confusion has reigned literally forever! Only a few odd people with a ‘mind for money’ and not much else have navigated truly well. These people dominated markets and business throughout history because they were mostly unemotionally connected to the rest of humanity and spent most of their days only focusing on the management of capital. They were generally considered ‘cold-hearted’. Seth Klarman is one of these. He says to understand how money works one needs to be born that way, he said Nov 1, 2011 in a 47min interview with Charlie Rose at the Facing History and Ourselves New York Benefit Dinner: http://vimeo.com/32333102

“There’s a gene for this stuff. For me it’s natural. For a lot of people it’s fighting human nature.”

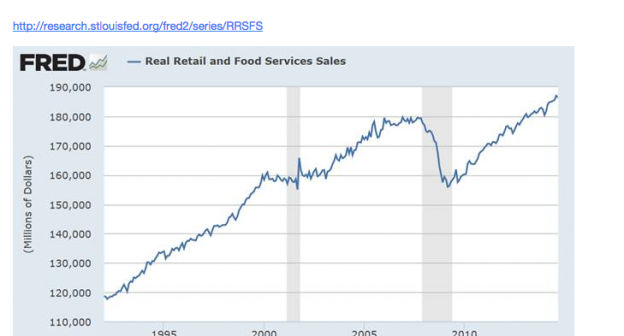

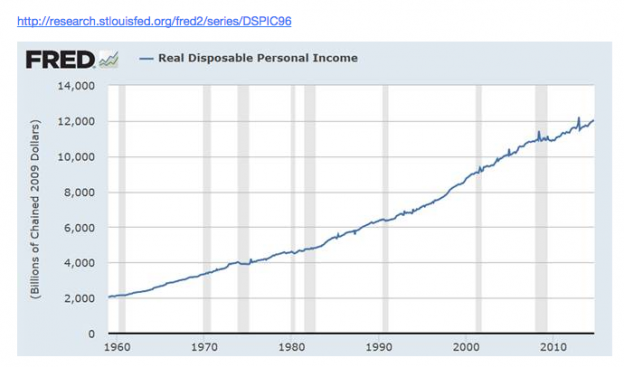

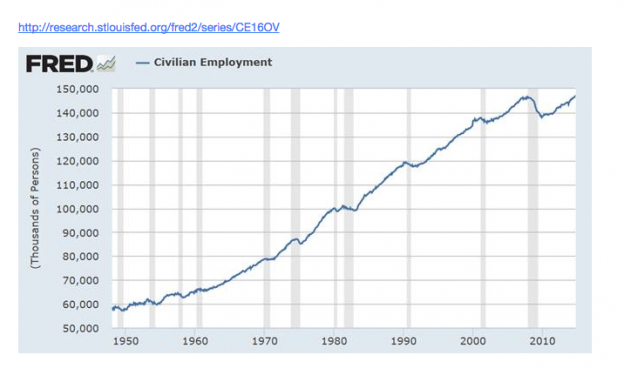

There remain today the same few who have those ‘value genes’ of which Klarman speaks. But, in my opinion, Value Investing can be learned by studying human nature and economic trends. Just as so many today do not understand that the charts below for Real Retail and Food Service Sales, Real Personal Income and Civilian Employment represent a real economic recovery, I believe that investors can learn to read these charts as easily as one does simple math in day to day transactions. I think the reason why investors fail to identify fact from conflicting points of view is due to letting the emotional content of misdirected market commentary in the media over rule common sense. A common sense view of the data presented in chart form below should convince one that a real recovery has been underway since early 2009 and that one should own as much equity with which one can sleep. For investment purposes, fixed income should be avoided as too risky as long as economic trends are rising.

Employment gains are REAL, Personal Income gains are REAL and Retail and Food Service Sales are REAL…

…stocks are rising for REAL ECONOMIC gains!

I continue to wonder how people are missing this recovery and this stock market rise ($SPY)! We are witnessing an amazing miss of investment opportunity.