“Davidson” submits:

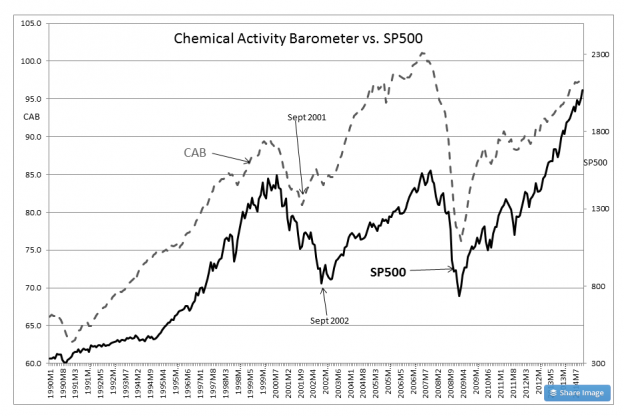

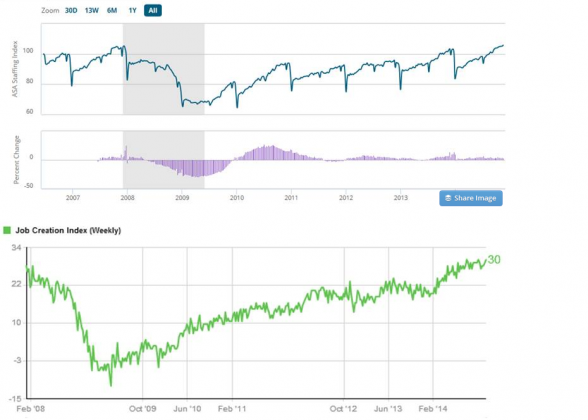

While many have fretted over the short lived market swoon we experienced in October, the Chemical Activity Barometer(CAB) hit a new high in the today’s report-see chart vs. SP500 below. At the bottom are the ASA Staffing Index which hit an all time series high of 106 and the Gallup Job Creation Index which is holding at its historical highs.

In spite of the oft expressed opinions every day in the media that personal income has been falling, employment is awful, the economy is awful, awful and awful, the economic evidence remains very much in contradiction to mass perception and the SP500/Dow Jones are hitting new highs for very good reasons. The US economy continues to expand without major support of bank lending, home building and commercial construction. If the current recovery repeats as we have seen recoveries of the past, then markets are not likely to peak till all sectors of the economy have not only fully recovered but run at full tilt for a couple of years. Housing, commercial construction and bank lending are all laggards today due to historically tight lending conditions. Stuart Miller, CEO Lennar ($LEN), said as much on CNBC yesterday, link: http://video.cnbc.com/gallery/?video=3000333246&play=1

All economic indicators are forecasting higher equity prices are likely in the months to come. The slowness of housing and general construction gives rise to expectations that this economy still has 5yrs-7yrs left in its expansion.

My recommendation continues to stress owning Equities ($SPY) and avoiding longer term Fixed Income to achieve the best Reward/Risk over the next few years.