“Davidson” submits:

Oil ($USO) ($OIL) has been much in the news. Falling prices have resulted in a good number of ‘Collapsing Economy’ predictions. A large number of analysts, too many to count, indicate that US oil production is the reason for a global glut and justifies a collapse in oil company stocks and a rise in retail stocks. Some call for negative impacts on various foreign currencies and financial systems. All seem to agree that excesses in oil production have occurred suddenly and without warning thus setting commodity markets into a veritable tailspin with loud calls on OPEC to sharply reduce supply to avert world calamity. Sudden change is unsettling and investors are concerned about another ‘Black Swan’. I do not think so!

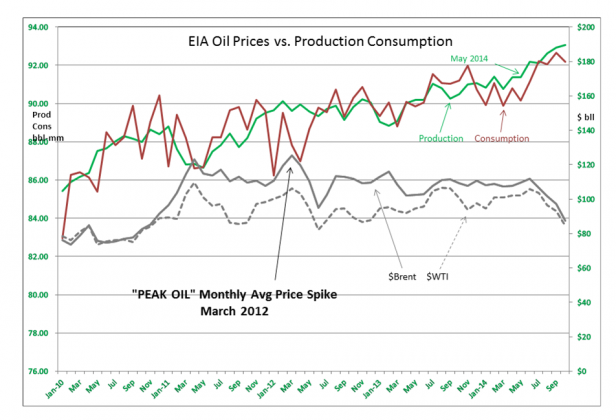

In my opinion, the facts suggest that something else is going on besides the end of the world as we know it. Below is the chart of the U.S. Energy Information Administration monthly data from 2010-Present. Link:

Let me walk you through some recent events and how this was reflected in price and lets see if I can convince you that something other than simple Supply/Demand is involved here.

1) Oil has a history of Production varying above and below Consumption being not matched for months at a time. One can see that the only time this Supply /Demand is ever perfectly in sync is when the trend line of one crosses the trend line of the other.

2) That market psychology impacts oil prices just as much as anything else which has human beings guessing at future price moves even when Supply/Demand would suggest otherwise. NOTE: March 2012 reflected the highest monthly average Brent price of $125.45 but July 2012’s price spiked intra-month just over $145bbl(monthly avg ~$102)-The fear of ‘Peak Oil’ occurred when Production averaged ~2million bbl better than Consumption Dec 2012-Jun 2013. This was pure market psychology!

3) As recently as May 2014 there was excess production of 1million bbl a day, but the fear of excess supply occurred only recently with panic liberally sprinkled to all corners of the financial markets. Why did excessive market concerns only build in the past 8wks?

First, notice that the values present in this data are statistical in nature. What this means is that not every barrel of Production/Consumption can ever be counted and statisticians need to make reasonable estimates which average out over time. Like any other economically important product, oil Production/Consumption does not ‘turn-on’ or ‘turn-off’ or even have the ebbs and flows shown in the chart. The actual trends are much smoother than we can count it. What we count is 1million bbl produced here or shipped there. Ultra Large Crude Carriers(ULCC) can carry up to 3.7million bbl. Counting one ship more or less in any month has a sizable month to month variation when we are dealing with a lump delivery of 2million bbl on a monthly base of ~90million bbl.

Market psychology can drive prices in line or against the supply/demand trends in place. This latest round of panic comes on the heels of a much talked ‘hyperinflation trade’ put in place by those who made significant bets the US$ would fall on the Fed’s adding excess liquidity in 2010-2012. The Fed did this specifically to spur housing and stock prices, i.e. to inflate asset prices. The Fed was and remains desperately afraid of ‘deflation’. Its primary focus has been to inflate asset prices and in its view expand economic activity. Investors, especially Hedge Funds, saw the Fed as behaving dangerously inflationary and positioned themselves to benefit from a falling US$, rising 10yr Treasury rates, rising oil, copper and other commodity prices as well as rising prices for farmland. If one reviews the news of the past 4yrs, it is quite easy to see that Hedge Fund managers as a whole were extremely worried about inflation and implementing positions to benefit.

But, “The best-laid plans of mice and men / Often go awry”, Robert Burns, 1785 Link:. Having positioned portfolios to benefit from a wave of anticipated inflation, Hedge Funds believed that they simply had to wait. But, 2012 passed and inflation remained calm! And, 2013 passed and even though the 10yr Treas rose from 1.6% to 3%, inflation continued to remain calm. Then, in early 2014 Russia invades Ukraine and it was reported that in excess of $200billion entered the US from Russian Oligarchs worried about what this would mean to Russia and their personal fortunes. Suddenly, 10yr Treasury rates begin to fall with the influx of capital flows seeking a safe-haven. As a consequence US$ began to strengthen. This begins to hurt oil prices which begin falling beginning in June 2014. Inflation continues to remain calm! The ‘hyperinflation trade’ had to be reversed as these bets begin to create losses. The result was a panic beginning late September 2014 and continues today. Note: October 2014 reading shows less of a supply/demand spread than what we saw when the world was panicking over ‘Peak Oil” in 2012.

Markets always reflect what investors, buyers/sellers, think something is going to be worth at some point in the future. At all times what we see is pure market psychology. Every transaction occurs because both buyer and seller each thought they ‘got a good price’ Mostly we assume prices reflect actual supply/demand because that is generally how it works. But, once an item gains alternative uses such as copper being used in China to back lending obligations or gold and oil being used as a means to bet on inflation, the reason for something’s price becomes ‘financialized’. This means that the price may reflect other than an item’s former use in society. This is what in my opinion is what we are seeing today.

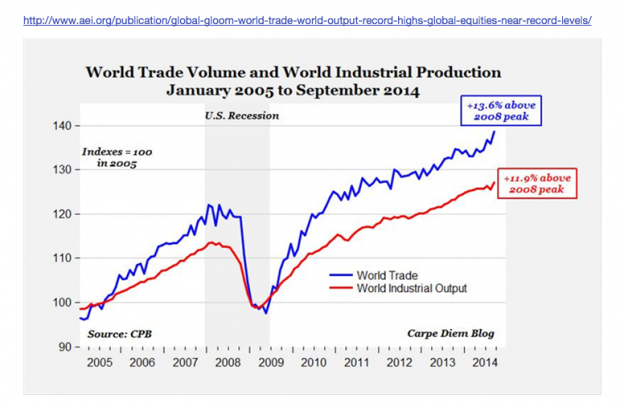

The charts show that there is not an unusual imbalance in oil supply/demand. Global growth is good and even appears to be accelerating-see Mark Perry’s link to his World Trade and World Industrial Production article at the bottom. We should expect to see global demand rise in the months ahead and reduce whatever near term imbalance exists. I come to the conclusion that the recent plunge in oil, panic buying in 10yr Treasury and strength in the US$ are all due to a panic reversal of a ‘hyperinflation trade’ of 2yrs-3yrs ago

I expect the current turmoil to pass and for oil to move back to levels where global societies required it to be, i.e. mid-$90s bbl. Oil at this level lets all nations who rely on pricing at that level carry on their established activities. At some point buyers/sellers will see this period as not a period of sudden excess supply, but one which saw a short-term shift in market psychology and we will return to levels which work for all involved. My guess is ~mid-$90bbl.

In most portfolios, we have carried a Natural Resource position in the range of 8%-10% which has declined. As we make adjustments to portfolios, I recommend that we reallocate to bring the Natural Resource position back to 8%-10%. Natural Resources are the basis of infrastructure and day to day living. We are experiencing a gradual uptrend in housing and commercial construction which I expect will expand as banks expand lending.