“Davidson” submits:

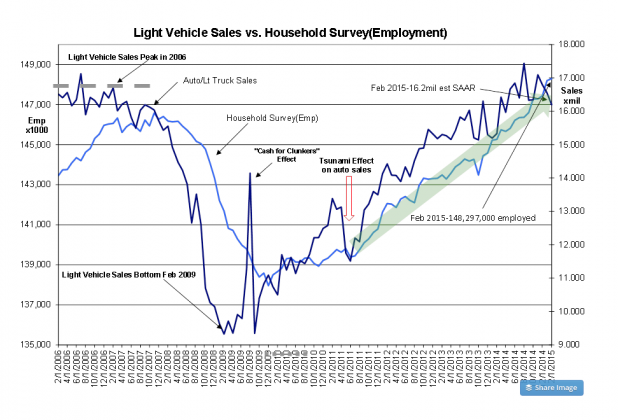

It gives me a chuckle when I listen to how detailed the parsing is on today’s employment data. Every analyst found something with which to find an issue, but it was not the same issue. When vehicle sales came in at 16.2mil SAAR(Seasonally Adj Annual Rate) reported earlier this week, the drop from the previous months was accepted as due to poor weather and no one took this as a negative. My observation is that we are seeing the gradual transition towards a more positive market psychology. Instead of every economic report being greeted with pessimism, we are seeing a shift to a mix of optimism and pessimism. The Light Vehicle Sales vs. Household Survey(Employment) chart is below. What is the most important feature is the 6mos trend in the employment series. Household Survey(Employment) continues in a nice uptrend and this simple measure of economic activity is really all one needs to know to invest in equities.

Higher Employment = Expanded Economic Activity = Higher Equity Prices ($SPY) ($QQQ)

This relationship is not mathematically precise, but it is conceptually correct if you are an investor not a trader.

I continue my mantra, “Buy stocks! Buy Stocks! Buy Stocks!” A rising economy lifts all ships. Yes, we will want to get out before the tide goes out, but the tide continues to come in. Based on economic indicators which no one seems to pay attention to these days, we should have up to 24mos of warning of a pending market top.

Current data provides confidence in the view that there is no economic peak visible for at least 12mos-24mos and subsequently no market top in that time frame.