“Davidson” submits:

I do some teaching. My materials are typically public sources which often contain gems others overlook because they do not have a context. I tell students you must develop long term context to understand how value is created. Buffett has done this.

How did Buffett know that the puts he issued would work out? The answer lies in the fact that they were long term and he set the expiration date, they could not be exercised against him at a time not of this choosing. To understand how Buffett thinks one needs to look at the performance of markets ($SPY) long term, i.e. 70yrs. From this perspective you can see why he felt he would make this bet.

Being forced into a long term perspective is the most difficult shift a student can make because there is an enormous pressure in the world to be successful over the short term. Success really comes over time by making consistently good decisions using a long term perspective.

Danaher’s history is actually far better than Buffett’s because Buffett uses ‘margin’ and Danaher has not.

Buffett Climbs From Derivative Hole That Swallowed Berkshire AAA ($BRK)

by Noah Buhayar

5:00 AM EDT

May 7, 2015

Warren Buffett’s derivatives wagers sapped earnings during the financial crisis at his Berkshire Hathaway Inc. and were part of the reason the company lost its triple-A credit rating. Things are looking rosier now.

Liabilities on the contracts shrunk to $3.5 billion on March 31 from about $15 billion six years earlier. Some of the derivatives are long-term bets that equities will rise, while others protect bondholders against losses if borrowers fail to meet their obligations.

Surging stock indexes in the U.S., U.K., Europe and Japan and a stronger dollar have helped reduce the liabilities on the equity-linked derivatives for years. The improvement accelerated in the first quarter, helping profit climb 9.8 percent to $5.16 billion, according to a company report Friday.

“Unless the world falls apart over the next couple of years, it’ll be another bet that he’s won,” said Meyer Shields, an analyst at Keefe Bruyette & Woods.

It didn’t always look that way. Liabilities on the derivatives ballooned during the financial crisis and contributed to a first-quarter loss in 2009. Moody’s Investors Service and Fitch Ratings cited the contracts when they stripped Berkshire of its top credit grade that year.

The large derivatives book seemed at odds with Buffett’s earlier statements. In 2003, he called them“financial weapons of mass destruction,” a phrase that would later be cited during the credit crisis that forced some of the nation’s largest banks and American International Group Inc. to take government bailouts.

Collateral Damage

Buffett spent more than four pages of his annual report in 2009 discussing derivatives and saying that his deals were different. He wrote that Berkshire was paid for taking on the risk, gets to invest the funds in the meantime, and rarely has to post collateral on the contracts, which won’t be settled for years.

In 2010, Berkshire lobbied members of Congress to exempt previously written arrangements from new collateral rules. Lawmakers eventually decided to grandfather existing derivatives.

Even as Berkshire’s liabilities have shrunk, the wagers remained a fascination. The Financial Times wrote an eight-part series, starting in 2013, about Berkshire’s derivatives tied to stock market indexes and how some of the contracts were more exotic than previously thought.

Buffett, 84, settled some credit-default contracts in 2012. Remaining deals will probably just run out over time, Buffett said at Berkshire’s annual meeting May 2 in Omaha, Nebraska. It’s unlikely that he and the counterparties could agree on a mutually acceptable price to settle them, he said.

Stocks, Bonds

Buffett’s patient approach on derivatives fits with his broader strategy of holding investments for years and paying little attention to short-term fluctuations. And he’s advised shareholders to think of quarterly changes in the liabilities as noise.

Berkshire received $4.9 billion in premiums through 2008 tied to equity-index puts. The contracts expire between June 2018 and January 2026; other deals pertain to debt with maturities from 2019 and 2054.

Buffett never won back the top credit grades. Berkshire is rated Aa2 and Moody’s and AA at Standard & Poor’s.

Since the financial crisis, Buffett has expanded his company through some of his biggest acquisitions. He bought railroad BNSF in 2010, added to Berkshire’s energy utility business and partnered with buyout firm 3G Capital to take over ketchup maker H.J. Heinz. Even if liabilities on the derivatives soar again, they probably won’t have as outsize an effect on Berkshire’s results, said KBW’s Shields.

“They’ve gotten small,” he said. “And Berkshire has gotten bigger.”

NOV 26, 2013 — 5:54 PM

The Buffett Put Trade

HTTP://WWW.CBOEOPTIONSHUB.COM/2013/11/26/BUFFETT-PUT-TRADE/

Four times a year Berkshire Hathaway submits a filing with the SEC that discloses their holdings. Most Warren Buffett watchers dig in to see what current holdings have been added to along with any new stocks that have worked their way into Berkshire Hathaway’s holdings. I dig into the filings as well, but I’m looking for something a little different. I want to see what’s up with the short put trade that Berkshire Hathaway initiated back in the 2004 to 2008 time frame.

Some people may be unfamiliar with the trade I’m talking about, but may be aware that Warren Buffett called derivatives financial weapons of mass destruction in the Berkshire Hathaway 2002 annual report. Part of the commentary around this thought had to do with Long Term Capital Management and the focus was more on over the counter derivatives. However, by 2004 Berkshire Hathaway began initiating a pretty interesting over the counter equity index derivative trade. They sold puts on major market indexes.

Between 2004 and 2008 Berkshire Hathaway entered into what is referred to in annual reports as their equity put trade. The firm sold over the counter put options that will expire 15 to 20 years in the future. These positions are on four major equity indexes (S&P 500, EuroStoxx 50, FTSE 100, and Nikkei 225). Also, Buffett has pointed out that these are European style options that may not be exercised until expiration.

Not a ton of information has been forthcoming about these specific positions. Buffett has noted that they are at the money put options written on those four indexes. Also, the timing was not too great as the majority of the trades were done between 2004 and 2007. A small number of trades were added in 2008.

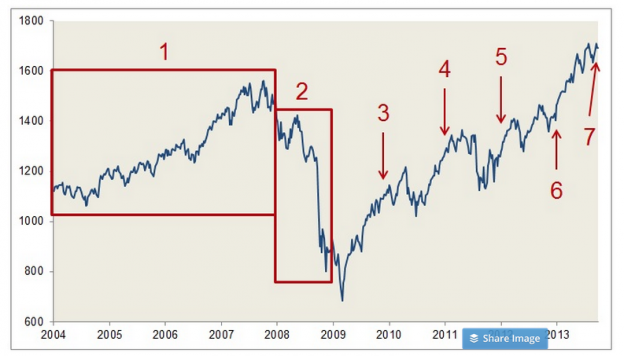

Below is a weekly chart of the S&P 500 with some highlights that coincide with the progression of events regarding these trades that appear after the chart.

- In Warren Buffett’s 2007 Shareholder Letter it is disclosed that from 2004 to 2007 Berkshire Hathaway had sold put options on equity indexes that were struck at the money. These put options had brought in $4.5 billion in premiums, were European style options, and were due to expire between 2019 and 2027.

- In the 2008 letter it was noted that the notional value of the put options totaled $37.1 billion and were written on the four major indices that were mentioned above. Buffett also states that they have added modestly to the equity put portfolio and have now received a total of $4.9 billion for selling these puts. Due to the drop in the global equity markets the valuation of these puts is a liability of $10 billion or a mark-to-market loss of $5.1 billion.

- In the 2009 shareholder letter Buffett discloses that the terms of about 10% of the contracts have changed. The maturities were shortened and the strike prices lowered. It appears that they rolled the strike prices down and gave up some time. However it was also noted that in these modifications no money changed hands.

- In the 2010 shareholder letter Buffett discusses that between 2004 and 2008 they received $4.8 billion in premiums for 47 equity index put contracts. It was also disclosed that at the instigation of their counterparty in these trades eight of the contracts were unwound. They had received $647 million for selling those puts and paid $425 million to get out of those obligations. This resulted in a profit of $222 million. This also left Berkshire with 39 short equity index put contracts on their books at year end.

- At the end of 2011 the book value of the remaining put positions was a liability of $8.5 billion. This is determined using a Black Scholes model. Buffett notes that if the options had all come due at that time the payment would have been $6.2 billion.

- At the end of 2012 the liability based on their open short put positions had dropped from $8.5 billion to $7.5 billion. Again this is based on a Black Scholes valuation.

- In the most recent 10-Q it appears the liability is down to $5.35 billion which is again based on a Black Scholes valuation. This was based on the S&P 500 at 1690 (more than 100 points lower than today’s close). If global equity markets hold their current levels we may get a mention in the next shareholder letter that says the value of these positions is finally under the $4.2 billion that was received for them a few years back.

When everyone else is trying to find out if Warren Buffett has added to current positions on has added a new stock to his portfolio I’ll be digging through the 2013 letter to for any mention of the short put trades.