“Davidson” submits:

The Monthly Supply of (new) Homes for Sale series tracked by the St Louis Fed is now at 4.5mo. Link: http://research.stlouisfed.org/fred2/series/MSACSR

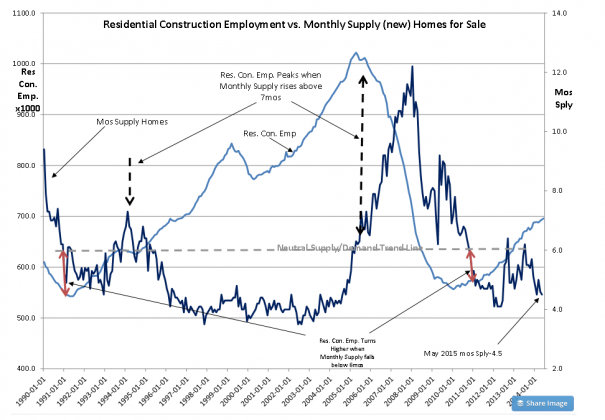

There is a correlation between the Monthly Supply of (new) Homes for Sale and Residential Construction Employment shown in the chart below. One can identify a Monthly Demand/Supply Trend Line above which we see housing contraction and below which we see expansion. Currently we are witnessing a period of expansion. 4.5mo supply is a relatively low number and reflects reasonably strong demand for the supply that is generated. That housing prices have been rising is a reflection of the fact that we still have a higher than normal portion of cash-only buyers. In other words it is those with existing wealth who dominate home buying at the moment.

It takes generally 9mos-18mos of rising monthly supply prior to a contraction in employment in this economic sector. At the moment the falling monthly supply indicates that future employment levels should continue to rise. Equity markets ($SPY) tend to peak roughly 6mos-18mos after Residential Construction Employment peaks ($XHB). Like any economic indicator there is nothing precise in the timing to pricing in the equity markets, but equity markets rise with housing market expansion and keep rising for a period even after the housing market has shown an economic peak. Why this should be so can be understood by looking at the details of a new home purchase. Housing is typically through mortgage issuance which looks backwards at recent financial history to qualify individual borrowers. A period of economic expansion often provides lending institutions reason to believe they have economic leeway to lower underwriting standards from stricter levels of the previous recession. Lending expands with economic expansion! On the issuance of a mortgage the new homeowner basically spends today a portion of his/her next 20yrs worth of future earnings. This type of spending only comes during economic expansion and accelerates economic activity much further than if this same spending was only at the same pace as earned. Spending on a new home lifts so many associated areas of the economy that the Mtg Bankers Association estimates that every new job in residential construction is responsible for another 7x new jobs else where in the economy. Expanding our use of leverage to buy currently what we can only afford based on multiple years of earnings is why economic activity is so cyclic. Once this excess economic demand for housing has been satisfied, an economic contraction has always followed. There is no reason why we should not expect the general historical relationships to repeat.

I expect that investors will eventually force 10yr Treasury rates higher as they seek higher returns. Higher mortgage rates will follow and with this lending institutions will have enough of a credit spread to expand lending down the credit quality scale. Do not be surprised to see an expansion in home buying and at the same time housing prices to stall. It is conceivable that those lower on the credit quality scale will buy lower cost homes once they finally qualify for mortgages. If so, the average home sales price will be impacted by lower priced homes even with an accelerated pace of home sales.

A 4.5mo monthly supply level is positive for economic expansion and higher future equity prices.