This is a powerful indicator. For a long time the increases in temp help were viewed as “bad” because folks were not being hired as permanent (even though temp help tends to lead to permanent hires). We now have a very interesting trend forming. The temp help index is falling (albeit slowly) while both BLS job openings and the Gallup Job Creating index continue to rise at an accelerating pace. When we combine that with recent labor and wage data (both weekly and hourly wages up since last summer) the main conclusion we can draw is that employers, due to steadily increasing competition for employees are going straight to permanent hires and skipping temp agencies.

This is a strong indicator of an significantly improving US labor market and that has historically always meant an improving stock market.

“Davidson” submits:

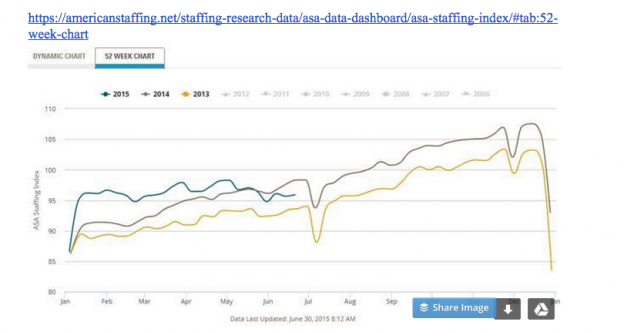

An unusual pattern has developed in the ASA Staffing Index vs. the Gallup Job Creation and BLS Job Openings Index which have in the past tended to track with each other in the past. A conversation with researchers at ASA indicate that multiple issues may be causing distortions at the moment. One of these suggests that labor demand has accelerated to a point that companies are beginning to hire more directly rather than use temporary placement for hiring needs. This reflects a higher level of confidence in business trends going forward. This results in less use of temporary help services as labor demand rises. This suggests that competition for labor is heating up.

Some may point out the ASA is showing economic weakness. However, this is not supported by the other indicators and certainly not supported by ASA researchers.

Equity investors should continue to expect higher markets the next couple of years.