“Davidson”submits:

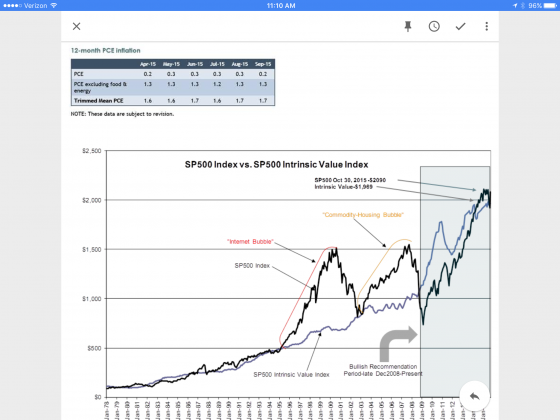

The SP500 Intrinsic Value Index ($SPY) was created to track that level of the SP500 which has historically attracted Value Investors. It currently sits at $1,969 with the latest release of the Dallas Fed’s 12mo Trimmed Mean PCE economic inflation at 1.7%-see the table. The SP500 in comparison sits at ~$2,090 which represents a relatively low level of investor speculation (~6% above the Value Index) compared to previous market excesses-see the chart. The SP500 Intrinsic Value Index is entirely my own construction. I believe it to represent SP500 levels attractive to long term investors, i.e. Value Investors.

Equity markets tend in the long term to rise in value with investor perception of the strength of the economy. The longer the period of economic expansion, the higher the market pricing. This is due to the fact that the psychology of investors skews along the pessimist-optimist spectrum with the economic trend. The psychological term for this is referred to as ‘The Recency Effect”. The Recency Effect results in significant differences between the SP500 Intrinsic Value Index and the SP500 after a period of one-sided economic news. Continued ‘Bad’ news forces equity prices lower while continued ‘Good’ news has the opposite result. The extent of the differences between the SP500 and its Intrinsic Value Index only carries significance in terms of historical market valuations. Major SP500 lows can be identified but not predicted using this indicator. Major SP500 peaks are due entirely to investor perception of economic trends and this index does not predict nor signal major market peaks. Where this index is helpful is in conjunction with multiple economic trends.

At the moment, the narrow difference between the SP500 and the Intrinsic Value Index, reflects the fact that there is little general speculation present. This is in keeping with multiple economic data series which are positive while many continue to believe global economic activity is weak. The facts remain that our economy as well as the global economy are alive and expanding.

My recommendation continues to favor equity and to avoid fixed income.