“Davidson” submits:

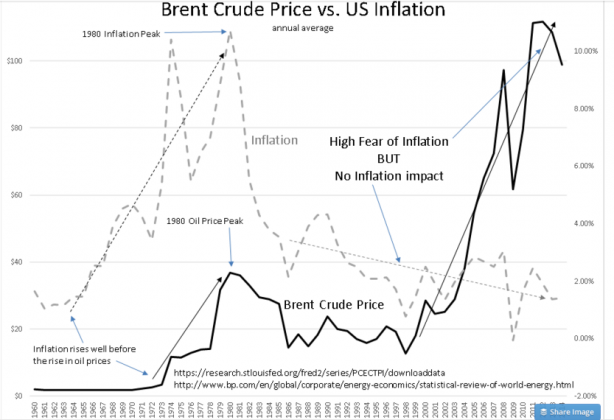

It has long been assumed that commodity prices and in particular the price of crude oil ($USO) ($OIL)drove inflation historically. Many believe today that OPEC was responsible for the massive US inflation in the 1970s. In the following chart Brent Crude Price is compared to US Inflation for the period 1960-2015. Brent crude price history used here comes from a historical composite of oil prices available from BP-see the links. There are two significant crude oil price rises in this history. Observations for these are revealing.

Observations:

1) Even though inflation and crude prices peaked together in 1980, inflation began to rise in 1965 with crude beginning to rise roughly 5yrs later in 1970-Inflation resulted in higher crude prices

2) Crude prices began to rise sharply in 2000 as demand from China/Emerging Markets use accelerated, yet inflation continued its down-trend from the early 1980s

It should be clear that oil prices, long thought to be causal to inflation, is in fact not correlated with it except in the minds of investors. I have been investing since 1975. I have always been fascinated by the market’s shift towards commodities and oil in particular whenever inflation fears (often a fear of disruption of supply due to geopolitical events). With the importance of Emerging Markets’ economic importance since 1990, especially China’s command economy demanding manufacturing be done locally for those who wished to have market access, fears of demand/supply issues for raw materials have ballooned over the past 20yrs. China did indeed drive commodity prices higher as it built hundreds of cities. The market belief that this would prove inflationary saw inflation bets rise in 2006-2007. Sub-prime lending in the US helped to fuel this thinking as the demand for real estate forced prices for housing at a pace which seemed unstoppable. Then, real estate crashed!

In 2008-2009 the Fed and China flooded their respective markets with various forms of easier credit to ease the crash. The well known maxim that,“Inflation is always and everywhere a monetary phenomenon”, by Milton Friedman had many believing that inflation was virtually guaranteed to occur. Many reestablished their inflation bets. Oil and other commodity prices rose. Clearly, as shown in the chart, inflation did not occur. What is seen in this chart is a rise in inflation due to the ‘Sub-Prime Housing Boom’, which quickly corrected as this bubble corrected. The gradual decline in the inflation trend which has been in place since the early 1980s resumed. Inflation today according to the Dallas Fed’s most recent 12mo Trimmed Mean PCE report stands at 1.7% where it has been for a couple of years.

Although we have come to associate oil prices with inflation/deflation, the correlation does not exist across the long term. Nonetheless, investors continue to be primed to fear the emergence of inflation and are likely to run into commodities and especially oil at the next hint that it may be looming around the next corner.

I continue to recommend a position in Natural Resource issues. I fully expect market psychology for this asset class to turn more positive at some point in the future and that turn should benefit portfolios.