I know of no other commodity known to such hyperbole as oil is…..from “peak” to “glut” in a couple years… I think I heard recently we were “choking on oil”

“Davidson” submits:

A New Year’s review of the global and US oil markets shows that while we have excess supply it is not the dramatic problem many believe. Charts show the US Oil Situation, the Global Oil Production Consumption & Inventory, separately US & China Petroleum Liquids Consumption derived from data provided by the International Energy Administration(IEA). IEA data does not have detailed figures for every country, but enough data to let one see what is occurring globally. For the list of OECD Members use this link: OECD members. Oil, a global product, has numerous inputs and requires examination of multiple aspects of the entire market. There are many inputs physical, economical, technological and political which makes precise measurement and prediction difficult. Yet, this does not mean it remains a complete mystery.

Would you believe that if we stopped producing oil today, the excess would disappear in less than 5 days?

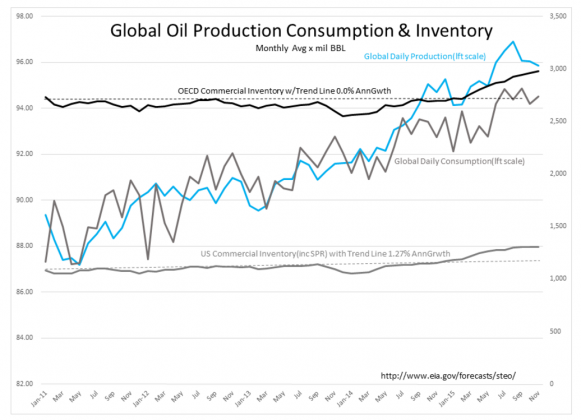

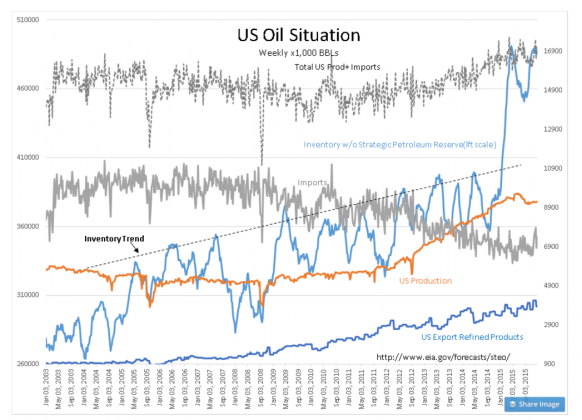

At the moment, the global excess inventory vs. long term inventory trend lines comes to 400mil BBL. To see this, look at the Global Oil Production Consumption & Inventory chart. Both US and OECD Member inventories are shown with trend lines. There is a vast system to produce, transport and refine oil. Actual deliveries from producers to consumers require inventory of oil in its various compositions from crude to refined products to smooth-out the flow between producers and consumers. Inventory control is even required to meet environmental regulations. One can see in the US Oil Situation chart that US inventory shows the well-known annual double-peak/double dip-pattern which comes from building seasonal transportation fuel blends required by environmental regulations. The rise and fall of inventory is coupled to the semi-annual shutdown required to change refining catalysts needed to refine different fuels for winter vs. summer driving. To insure smooth delivery of products, inventories need to be raised to meet demand when refineries are in shutdown. There is always a requirement of some inventory to insure smooth delivery of the desired product to the meet the needs of the customer. That level of inventory is represented by separate trend lines for US and OECD in Global Oil Production Consumption & Inventory. Measuring inventories as of Nov 2015 for US and OECD Members against the long term trends provides a total global inventory of 4,285mill BBLS vs. trend inventory level of 3,885mil BBL. Current global inventory is 400mil BBL more than trend. 400mil is far less than the 3bil+ BBL of excess inventory which some have used in dire forecasts. With global consumption at ~95mil BBL/Day, 400mil BBL excess above normal would last only 4.21 days if everyone stopped producing.

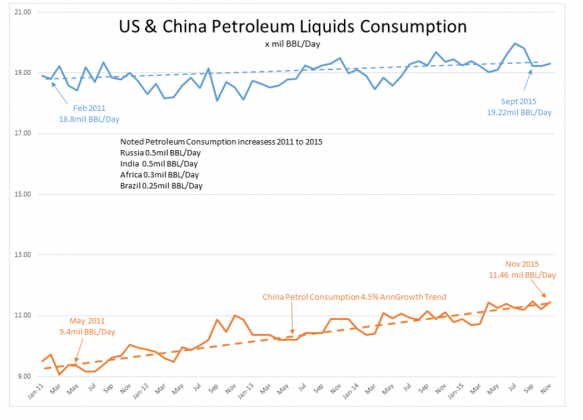

Inventory excess-above historical trend-did not begin till Jan 2015 and now sits at 400mil BBLs. Global inventory increase is entirely from the rise in US production. The IEA data show 0.0% growth of OECD inventory levels. The main influence on global oil consumption has been China, but increases in consumption occurs in Russia, India, Africa and Brazil shown in US & China Petroleum Liquids Consumption chart. Global oil consumption is rising ~1.5mil BLL/Day annually. That is ~550mil BBL annual increase in consumption. The 400mil BBL of excess inventory can disappear very quickly.

US Inventories appear to have stabilized since Jun 2015 at a higher level as can be seen in the US Oil Situation chart. IEA data tell us that total global consumption has grown from 2011 thru 2015 from 88mil to ~95mil BBL/Day or ~1.5mil BBL/Day. At this rate any excesses will be consumed shortly. One year of additional consumption growth will require ~550mil BBL-400mil BBL will not last long in excess. Consumption growth is strongest in China with an increase of 2mil BBL/Day 2011 thru 2015, but Russia, India, Africa and Brazil added another 1.55mil BBL/Day of global consumption. Total consumption increase from these sources comes to 3.55mil BBL/Day in ~5yrs or ~0.7mil BBL/Day. These countries account for roughly half the annual global consumption growth reported by the IEA. We often hear of economic weakness in Russia and Brazil and we hear little about Africa as adding to economic growth. Consumption of transport fuel indicates that there is more growth occurring than many perceive.

400mil BBL is roughly what IEA data indicate is the global oil excess is today. This is not close to the vast quantities which have been mentioned in the headlines. 400mil BBL represents less than 5days at current global consumption rates. The global economy continues to expand with the US as the primary driver. The current level of pessimism regarding low energy prices does not correlate with the facts. Market psychology has always had a ‘bogyman under the bed’ mentality.