“Davidson” submits:

The past year’s pessimism in the face of continued economic improvements has within in a couple of days shifted to panic. Multiple forecasts for oil prices to plunge to $20 BBL, even $10 BBL were issued yesterday. One firm says “Sell Everything!” Yet, in the face of all this, the economics are quite sound. Why is the market panicking and not seeing the obvious economic strength?

In 1841 British journalist Charles Mackay published the book Extraordinary Popular Delusions and the Madness of Crowds. Mackay’s book, classic reading for Value Investors, is best known for his description of the March 1637 “Tulip Mania Bubble”, https://en.wikipedia.org/wiki/Tulip_mania. Senselessly investors were willing to pay more than 10 times the annual income of a skilled craftsman for a single tulip bulb. We like to think that we are immune from this, but modern bubbles occur relatively frequently. The “Internet Bubble” occurred 1995-2000, the “Peak Oil Bubble” was 2005-2008, the ”Sub-Prime Bubble” began in 1995 but the truly dangerous lending was 2005-2007. Get enough people thinking along the same direction that something is worth more or less, get enough people talking about it, get it in the media and get crowd believing in the logic of the consensus (even if there is adequate evidence to the contrary) then individuals enter the realm of delusion. The “…Madness of Crowds” can happen very quickly. We are seeing this today.

The majority of investors are Momentum Trend Followers. Momentum Investors believe that stock prices carry all the information necessary with which to make investment decisions. Economic fundamentals are not a factor in this approach except to find a reason to justify what they believe price trends are telling them. In other words, if the price trend is down, Momentum Investors will find an economic fundamental to support the trend, even if they are incorrect in doing so. It is the act of forcing numbers to tell one’s point of view even with misplaced reasoning. This is emotional investing.

Momentum Investing is emotional investing. It has no basis but for a price trend which ‘feels good’ or ‘feels bad’. There is no connection to fundamental returns with this approach. That ‘price trend’ is not an economic return measure is difficult for the majority of investors to grasp. Most think prices reflect the consensus analysis which is better than analysis by individuals. However, the overwhelming majority of investors do not use fundamentals. They do not know how to do so. Instead they believe that market prices rely on someone who does know how to do this and that markets price securities ‘more correctly’ and regardless of price level. If revenues are higher than expected, then the price should go higher. If revenues under-perform expectation, then price should fall. This is crowd investing. This is investing on the psychology of expectations of other investors. This is what Momentum Investing is all about. Momentum Investing is the belief that a crowd of investors are better at understanding the value of a company than any other approach. When the majority carries the belief that someone who actually knows what they are doing is responsible for market prices then ‘Consensus Logic’ is not logical!

History reveals that major market corrections only occur when the fundamentals, the true fundamentals, have turned down. By ‘True Fundamentals’ I refer to economic activity. The combined day-to-day individual striving to improve one’s own and one’s family’s standard of living which shows up in increases in Employment, in Real Personal Income and Real Retail Sales. Major market corrections do not occur unless these economic indicators reflect a down-turn in these fundamentals. Today there is no evidence to support a correction!

‘Group Think’ has focused on oil prices as the primary indicator of economic activity and falling oil has panicked investors into believing an imminent correction is upon us. One firm even said “Sell Everything”! Oil prices are like any other prices. They are simply set by ‘Group Think’. With the strong US$ bet being made today by Hedge Funds which have dominated short-term pricing since 1995, we have witnessed considerable shifts in price levels for commodities, currencies and fixed income securities all of which become interpreted by Momentum Investors into illusionary economic misperception. Meanwhile, the economic fundamentals which continue to expand are lost as investors strive to explain price trends which are short-term psychological gobbledygook!

As Value Investors we should take advantage of ‘Group Think’. Looking through low prices to fundamentals, one finds that Growth of BV/Shr rates and dividends of many issues exceed that of long-term GDP growth buy substantial levels. There are many names to choose from. Some of the better known are Exxon Mobile, GE and Caterpillar. These companies have true fundamental growth of Shareholder Equity which at current prices make their returns much higher than long-term GDP growth of 4%-5%. The high fliers of today are priced at such high levels that the returns to shareholders are minuscule. Contact me for particulars.

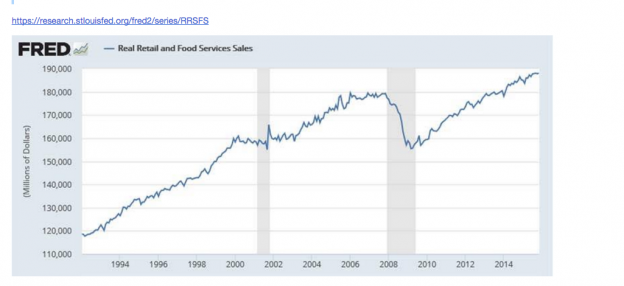

Meanwhile, US economic growth continues as can be seen in these charts from the St. Louis Fed’s FRED site:

When the Jan 2016 employment report came out, media pundits down played the 292,000 rise with 50,000 higher revisions in previous months as all seasonal adjustments and was in fact mediocre. Nothing could be further from the truth This is an oil price trend justification.

Greater employment results in higher Real Personal Income. Individuals do not work and corporations do not hire unless there is real(inflation adjusted) value created for all. Real Personal Income is a measure of the standard of living. The more one has to spend on what one chooses to spend it on after being adjusted for inflation the better off one is in any standard of living.

Rising Employment and Real Personal Income is responsible for the rise in Real Retail and Food Service Sales. Economic activity this cycle has been frequently discussed as due solely to Fed easing causing stock prices to rise because rates are low. Stocks are higher because of real increases in earnings caused by higher Employment, Real Personal Income emanating from a rise in Real Retail and Food Service Sales.

NB: In each of the FRED charts above it can be seen that slowing economic activity occurs prior to recessions. Nearly every economic measure provides early warnings of recession and subsequent market correction 6mos-18mos ahead of time. There is no sign of correction in current economic trends.

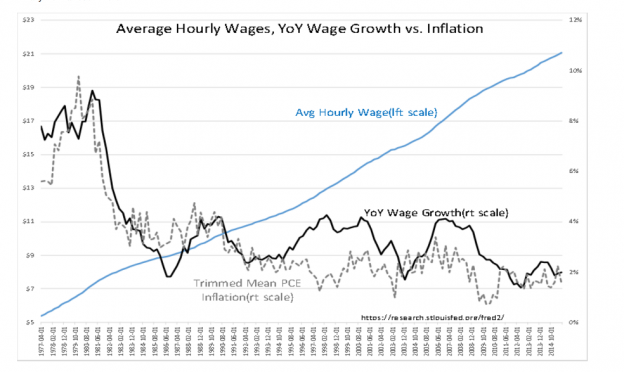

One of the major myths of this economic cycle is that Wage Growth has been very low. What has been missed is that Wage Growth has always been correlated to inflation. High wage growth occurs during high inflation and low wage growth during low inflation. Across economic cycles, wage growth has always exceeded inflation. This must be so! Net/net individuals will not work to lower their standard of living if they have a choice. On average individuals will move to find wages which improve their standard of living. Current wage growth is averaging higher than inflation a it has in the past. This is why Real Personal Income is rising and why Real Retail and Food Service Sales are rising. This is a real economic recovery and not some artifact of low rates.

Economic growth is continuing. Oil falling is due to market psychology and not a measure of economic fundamentals.

Many good values are available in the current environment. I recommend taking advantage of the current panic in ‘Group Think’.