“Davidson” submits:

It has been an interesting several years by any measure. Wild swings in the Chinese markets, wild swings in oil prices, copper prices, iron ore prices and a wild shift in the value of the US$ against other currencies. Every swing in price brings commentary that it means something good or something bad for the economy, for global trade and for future stock prices. Economic indicators just registered record levels of employment, vehicle sales, retail sales and personal income while many are calling for recession and significant market corrections. Investors become very confused whenever prices fall contrary to positive economic trends. The biggest question in the room, “Has something been missed?” The answer lays in the fact that Momentum Investors and Value Investors view the market differently.

There is a wide gulf between Momentum vs. Value Investor perception of what drives market prices. Value Investors see strong connections between business and economic returns and market prices. Momentum Investors are not able to make these connections. They do not believe such connections are possible. Momentum Investors expect to see economic data which comes out monthly to impact the market immediately. The focus of Momentum Investors is short-term. They are traders. They use leverage to enhance expected gains and are forced to reverse positions quickly whenever a short-term bet has turned against them. Their high use of leverage does not permit long-term investing. Often leveraged positions are enhanced further through the use of derivatives which add greater potential for gain, but they also increase the potential for loss. Market volatility has increased as a result. The majority of market activity comes from a group of short-term trend following investors called Hedge Funds. Wikipedia has a good summary: https://en.wikipedia.org/wiki/Hedge_fund

There are many style categories in the Hedge Fund world. I place Risk-Parity in the same category as Momentum Investors. Hedge Fund Risk Parity investors seek to profit from short term market pricing differences between asset classes. They follow trends in multiple asset classes and using algorithmic based programs, asset class positions are bought and sold when a trend deviation occurs. Risk Parity has gained in popularity the past 10yrs especially once the SEC eliminated the “Uptick Rule” July 2007.. Wikipedia has a good summary: https://en.wikipedia.org/wiki/Risk_parity Risk Parity investing does not pay attention to economic fundamentals. Fundamentals do not matter to many investors. All that matters for most investors is that something should go up if they buy it or go down if they short it. Rapid trading, trend following and the mistaken belief that rising or falling prices indicates changes in economic trends is responsible for a term unique to the current market referred to as FANG stocks. FANG, a term Jim Cramer coined, refers to the four top momentum stocks, i.e. Facebook, Amazon,Netflix and Google. Each is in the SP500 and together have been responsible for a disproportionate percentage of upside performance. An article on the site Zero Hedge explains this well.

http://www.zerohedge.com/news/2015-12-08/going-fang-less

“The acronym FANG…constitutes 4 stocks: Facebook, Amazon, Netflix and Google. These companies are the markets darlings for good reason; since June they are up on average 40%, whereas the S&P 500 is flat over the same period.”

The article continues on to compare these issues to the pricing of the SP500 and estimates that Google’s financials need to grow by 80% to justify its current price. The financials of the other FANG issues require much larger increases to justify their prices, Facebook by more than 400%, Netflix by more than 1700% and Amazon by more than 5,000%. These issues have been the darlings of the media for several years and every headline ever so slightly positive has driven their prices higher. In earlier notes I have called this investing with the headlines. Their performances have been praised by many without comparison to fundamentals. From a Value Investor perspective they are more than a little over-priced. For FANG issues to have risen on average 40% means that the other 496 issues had to average a net loss. This is why one has to be careful using the SP500 or any index as comparison for performance over less than a full market cycle.

Risk Parity and other Momentum Investing strategies often skew short term performance metrics. With algorithm’s incorporation of oil as an economic indicator, much like “Dr. Copper” in which copper prices were thought to provide a ‘fool-proof’ economic indicator, petroleum pricing has been used as an indicator for inflation and global economic trends and stocks have been traded accordingly. In the current environment, oil’s price has fallen below $30BBL and many forecasts have emerged expecting slowing of global economies and looming global recession. In stark contrast economic indicators which have always proved to have been the harbinger of economic corrections reveal no such slowing is occurring. This is the classic dichotomy between Momentum Investors and Value Investors.

Known Value Investors are positive and adding capital to equities. Both Warren Buffett and Carl Icahn are actively buying oil stocks: http://www.forbes.com/sites/bryanrich/2016/01/15/billionaires-buffett-and-icahn-doubling-down-on-these-energy-stocks/#2715e4857a0b32e8bcda3555

Leon Cooperman was interviewed on CNBC Friday, Jan 15th. http://video.cnbc.com/gallery/?video=3000481158&play=1. I thought Cooperman spoke so well in explaining his current view of markets that I created a partial transcript of his remarks.

“…the SEC made a very big mistake in 2007, July to be precise. In (the SEC) 1938 enacted the “Uptick Rule” to deal with the abuses of the day and that worked well for 70 odd years and then in July of ’07 they eliminated the “Uptick Rule” which I think gave rise or aided and abetted all these quantitative trading strategies and systems that are largely momentum based not fundamental based. So they are in the business of buying strength and selling weakness which exacerbates the moves in the markets which is scaring the hell out of individuals and frankly professionals and is not a good thing.”

Cooperman:

“Bear markets are associated with one of four factors.

Factor number one and most importantly the stock market smells an oncoming recession and then declines on the anticipation of recession.”…”There is a soft-spot going on but there are no signs of recession. The kind of things you look for declining employment, rising unemployment, rising initial claims for employment, none of this stuff is forecasting recession. And we don’t see a recession, and that’s number one in my thinking.

Number two reason you have a bear market, the market became euphoric in its pricing, very sloppy, very over- valued and vulnerable to a big decline. And this is being very judgmental, I wish I coined the phrase myself, I didn’t, this is John Templeton, but he traced out the arc of market cycle, he said bull markets are born in skepticism, they mature in optimism and they die in euphoria. Well pessimism was gone and we have been fluctuating between skepticism and optimism, but I don’t see any sign of euphoria in the market. The market as we speak at the moment is 15 times earnings, not unreasonable, not over-valued, particularly attractive relative to the alternatives. And, you know, the 15 multiple happens to be in line with the 60yr average, the last 60yrs the multiple of 15 the government was 6.67, currently at 2, OK, so the 10yr is a third of where it has been yet the market is in line with where it has been normal and the T-Bills I think have averaged between 5 percent the last 60yrs is currently near zero, so there is no sign of euphoria even if you go back 6 or 8 months ago and you know maybe biotech was overvalued, you could argue about the ‘fang’ stocks, but the broad market is not overvalued.

Third cause for a bear market was a geopolitical event which by definition you can’t forecast but you have to say that gold is not telling you anything about geopolitical event.

The fourth reason is the Fed takes the punch out of the punch bowel, but the Fed has been very reluctant to move. So, I am of the view that the market is going down to be bought.

When I started the year I said the market was in a zone of fair valuation, that the big catch-up is behind us and what I mean by the big catch-up, if you take 2012-13, 14 and 15, those four years and average them, the Real GDP grew at 2.3%, the CPI average 1.3% for four years, earnings grew at 5.3%, the Treasury bond just taking current coupon averaged 2.2%, and the T-Bill rate was zero. Meaning, if you sat on cash you earned zero for four years. In that same four years you made 16.5% per annum in the stock market. Well that game is over. You don’t have an economy growing at 2 and profits growing at 5 and making 16% in the stock market. But, I think that if we don’t have recession, which is my bet, basically, and shapes my view and the average common stock in 2016 will perform better and catch up to FANG*. And if the market is forecasting recession, it is not a structural issue basically, then I think FANG drops to catch up to the average common stock.”

Other Cooperman links:

http://www.cnbc.com/2014/07/15/alpha-addict-the-amazing-career-of-leon-cooperman.html

http://www.cnbc.com/2015/09/03/risk-parity-shares-blame-for-market-ructions-says-omega.html

Brian Wesbury another Value Investor states his view that current markets are a buying opportunity: 3:56min Click here to watch the latest Wesbury 101 – This is a Buying Opportunity

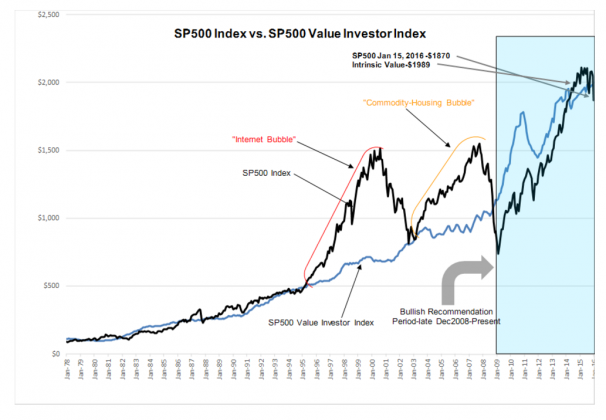

Last and not least, is my SP500 Value Investor Index (formally called the SP500 Intrinsic Value Index). This index is designed to capture the valuation parameters Value Investors use when deciding to invest. When the SP500 pricing is near and even more so when it is below the SP500 Value Investor Index, Value Investors view SP500 issues as attractive investments. The SP500 is priced ~100pts below the SP500 Value Investor Index currently and as if on cue, Value Investors have been buying equities and offering their perceptions about the attractiveness of the market.

My advice is to ignore the negatives and buy energy and other Value type stocks. Yes, ignore the FANG stocks as they are over-priced and have traded much higher than they deserved based on fundamentals simply because they have received so much media support.