“Davidson” submits:

The comment about markets being ‘broken’ has been echoed by many. History indicates that this type of extreme has been repeated numerous times and the turn comes as common sense recognizes that it is extreme. Putting a price on when extreme market psychology turns or any market price prediction misperceives the unpredictable nature of investor psychology. When Momentum Investors shift to extreme positions not supported fundamentally, Value Investors see opportunities.

In any week there are hundreds of predictions based on price trends. The truth is price trends have never predicted economics. ‘Big Picture’ is actually much more simple! It only looks so complex because there are so many differing opinions. Part of the ‘art of investing’ is to clear away the myths from reality. The only way to do this is to develop a long term perspective. By ‘long term’, I mean a period of time based on the economic cycle. It is the economic cycle which eventually drives investor psychology even if it occasionally swings to an opposite extreme. One can see this every day as reports come in either above or below expectations. Investing on the expectations of a single report is how most investors, including those who claim to be ‘sophisticated’, invest. This is why we see such volatility. Today’s market seems out of control, but our history reveals that what we see today is no different than what investors have seen throughout time. Not knowing how markets are connected to economic fundamentals is the Hallmark of Momentum Investors. Momentum Investors create headlines like the two below.

“Gasoline Trades as If U.S. Nearing Recession, Goldman Says”

February 17, 2016 — 6:50 PM EST Updated on February 17, 2016 — 11:09 PM EST http://www.bloomberg.com/news/articles/2016-02-17/gasoline-is-trading-as-if-u-s-nearing-recession-goldman-says

“Strategist for $1.7 Trillion in Funds Says Rout Has Room to Run”

February 16, 2016 — 7:06 PM EST Updated on February 16, 2016 — 8:49 PM EST http://www.bloomberg.com/news/articles/2016-02-17/strategist-for-1-7-trillion-in-funds-says-rout-has-room-to-run

As I monitor markets throughout the day, the week and year, I estimate that Momentum Investor predictions based on trend following likely account for 90%+ of all media content. Traders always have something to say about the impact of the market’s twitching one way or another. They insist listeners follow their lead if they seek investment success. If only every analyst came with a ‘nutrition label’ (the analyst’s investment record) so investors could judge whether this person’s perspective had value. The mutual funds and individual corporations have track records. Why not these so called ‘gurus’?

If one is trying to understand markets, listening to the veritable ‘Tower of Babel’ presented by the media is not going to be helpful. This has been the same since trading shares of companies were first recorded in the early 1300s. Then and throughout much of history we did not have the body of economic data we have available today. Economic trends operate across years and decades. Even though one is investing for the current economic cycle, one needs to do this with the perspective of all recorded economic history in order to invest with some degree of success. It is the ‘Big Picture’ of the current cycle not if this month’s report has met or not met expectations that is important. Long term economic trends represent the daily activity of billions of individuals, each making generally independent economic choices to improve their individual standard of living. A Free Market is one in which individuals have freedom to choose between multiple competitive offerings. Human activity in detail is impossible to capture in real time. Our measurement of this activity is often via proxy and estimate. Our measurement of this activity is revised frequently as we seek to refine the accuracy of the data. We even refine whole data series adding additional sources not employed in prior data collection as our society becomes ever more sophisticated. Regardless of how data is collected and revised, it is the 4mo-6mo trend of fundamentals which is important, not monthly reports and absolutely NOT the price trend.

My role as an advisor is to sort through this ‘Tower of Babel’. My role is to point out what is important and what is not. My role is to point out when investor psychology has run amok to one extreme or another so that we do not ‘bail out’ or ‘rush in’ to the long term detriment of investment capital. My role is to keep investors centered on economic fundamentals and to reaffirm this throughout the cycle. As investors we want to hold equities when the evidence supports doing so is in our long term interest. We also want to exit equities when it is apparent that the current economic cycle is peaking. Today, I continue to recommend staying invested in equities even in the face of the dire forecasts represented in recent headlines. I issue notes frequently because investors often inquire if “…markets are telling us something” and so few advisors provide longer term advice with underpinning fundamental documentation.

The ‘Big Picture’ is pretty simple with economics. Three charts represent how this works. Each is available at the St. Louis Fed FRED site using the link.

The first chart shows Job Openings. There are multiple measures of labor demand one can use and I use all of them in my research i.e. the Gallup Job Creation Index, the ASA Staffing Index, the Conference Board Help Wanted Online Index, the Bureau of Labor’s Temporary Help and etc. The St. Louis Fed chart shows that growth in Job Openings stalls 6mos-18mos prior to economic corrections. This data series is one of several which provide the early warnings of economic tops. The fear of recession of which hear of today is has no support from Job Openings.

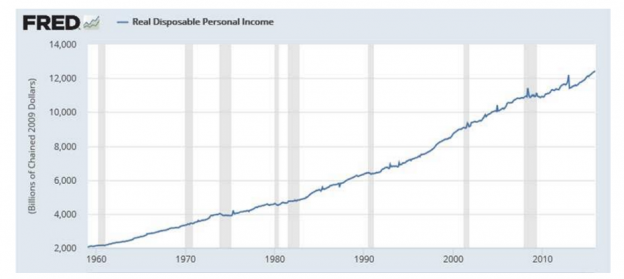

It is the demand for labor which is translated economically into higher levels of employment and increases in Real Disposable Personal Income. The much repeated “…non-existant Hourly Wage growth”, something which our Fed seems to believe as well, is not supported by the rising trend in Real Disposable Personal Income. I come to the conculsion that the Fed simply does not understand the imprtance of this data series. Recessions occur when the trend in Real Disposable Personal Income shifts toward being flat which occurs after labor demand slows. No such signals are present in the data.

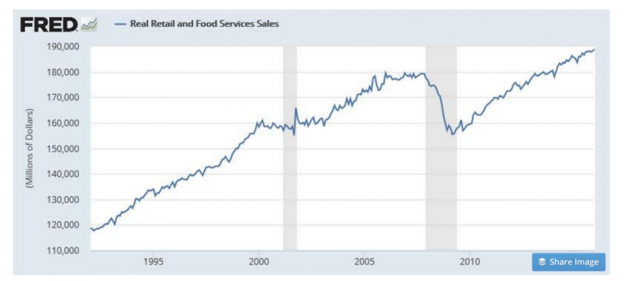

Increases in labor demand, Job Openings, which lead to higher employment, which leads to higher Real Disposable Personal Income, in turn leads to higher Real Retail and Food Services Sales. Real Retail and Food Services Sales shows that this data stops rising 18mos-24mos prior to a recession. No such indication is present today. None of the economic data is signaling economic slowing.

The short term nature of Momentum Investors dominating our markets today causes many to believe that markets are ‘broken’. NOT SO!! Momentum Investor price trend following has been a feature of markets from the very beginning. It is the belief that market price trends carry ‘hidden’ information or information not available to the average investor. It is why some use the reports of corporate insider buying/selling. (I use this information as part of my work, but more important is what corporate insiders say they are going to do and how they eventually perform.) Markets are not ‘broken’. Markets have always have had periods of extreme investor psychology which differed from economic trends. We see today. Insiders are buying heavily because they are better attuned thru their respective corporations to economic activity than investors who have become caught up in price trends. I created the SP500 Value Investor Index from economic fundamentals to help me gauge better what Value Investors were seeing which caused them to buy equities. The better value investors are buying today’s market, i.e. Buffett, Cooperman, Ross and etc. In spite of overwhelming negatives, fundamentals remain quite positive and the equity markets provide ample investment opportunities.

The ‘Big Picture’ is pretty simple. Excessive Momentum Investor pessimism in the face of continued economic expansion provides investors with a good buying opportunity once again. Buy equities, I am!