“Davidson” submits:

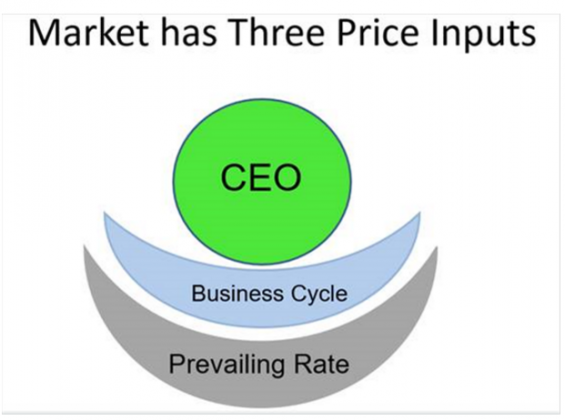

Markets have as inputs market psychology which sloshes about concerning 3 key investor perceptions-see figure:

1) Basic to all is the Prevailing Rate which is economic growth + inflation. The psychology around this is something you just experienced. Deflation was feared in 2008-2009 followed by fear of hyper-inflation in 2010-2014 and now we are again turning back to inflation in 2016. The market’s currency, commodity, rate and equity swings have been substantial due to swings in our ‘Inflation Thinking’. One needs to know how market psychology differs from fundamentals at this basic level.

2) 2nd in importance is the business cycle and how it evolves. Shifting from recession to recovery results in earnings increases which drive stock prices higher. Everyone tries to catch a ride and not be in the wrong place at the right time. Very often investors in such a rush only look at revenue increases or even drop back to measures which they believe will produce revenue like ‘users’ or ‘clicks’ to anticipate future gains. Mostly the media and growth dominate the discussion about new businesses and claims of huge rates of growth. The truth is that most investors are Momentum Investors and simply chase price-trends finding reasons to justify the trends using any fundamental measure which they think fits. These are mostly investors uninformed in fundamental analysis. Value Investors who number in single percentages, I call understanding Value Investors “The 1% Solution” because there are so few of them in the overall investor population. One needs to identify the fundamental economic trends from the misperceptions of hoards of investors who simply do not know how to look at the longer term correlations of economic activity vs market prices. Again, one needs to separate out the economic trends vs the market psychology and market prices.

3) Last but not least is what are the true drivers of value. How do corporations operate to create the long term value which drive market prices longer term? This is the basis of the Danaher note I sent earlier. It is all about continuous improvement and adding value to consumers such that society’s standard of living improves and the corporation remains relevant and profitable. One needs to separate out real value growth from the many misperceptions which drive prices. This is where BV/Shr growth comes in.

The way most research is performed because so much detail is available is to break the task down into pieces, have different people and departments do the tasks and report on their final result with a strategist supposedly bringing it all together. This leaves a great deal of nuanced information ‘siloed’ that never comes into consideration, especially the human ability to reassess individual economic situations and change direction. Individual analysts may see the human impact, but I have very rarely heard anyone use it the way I see it operating in the companies which are called ‘Lean’. Analysts are generally discouraged discussing anything which cannot be represented in ‘numbers’. The focus on ‘numbers’ is deemed the ‘scientific method’. Unfortunately, this misses crucial elements behind the most successful investments, i.e. employee engagement and the relationships of CEOs to the individuals in their corporate workforce which drive it.

The only way for students to understand all the psychological inputs to market prices is for them to connect the dots between the siloes the world has created. This means doing it all by one’s self. To do this successfully, you need to focus not on minutia, but learn to see how the broad economic trends interact, how they play out in the marketplace via investor perception (most often misperception) all the way down to individual corporation performance.

Basically, I find good CEOs as I have laid out in the Danaher piece, I find good portfolio managers using 15yr+ histories with low portfolio turnover and then invest during the period I identify as the economic up-cycle. Since virtually no equity can rise during an economic/market correction, I will shift all portfolios into 5yr Treasuries which rise as panicked investors seek safety from falling stocks.

I let the good CEOs and portfolio managers make all the decisions necessary for their specific arena and bet that an up-market will carry the better performing companies higher for the up-cycle. I do not attempt to know all the details of any investment or portfolio of any portfolio manager. I ignore the FANG type stocks which occur every up-cycle but in the long term usually cause great losses for investors. I want the Danahers of the world for the major economic up-cycle and 5yr Treas for the major economic correction.

The only way to understand what is driving market psychology which in turn drives prices during the cycle is to know where the Prevailing Rate prices the market, where one is in the current economic cycle and what the market is paying for ‘value creating’ vs ‘non-value creating’ corporations. You need to have a very good ‘Top-Down’ perspective of value vs market psychology and not let someone’s paranoia push you out of a market when the value is present and likewise not let someone’s excess enthusiasm bring you in when the value is not present.