You’ve seen the stories today about consumer debt and the media ringing alarm bells…..but is it true? Of course not

This goes to the 2008-09 hangover. Everyone wants to be the first to call the next “top” in something so they can gather the accolades that come with it. We’ve heard countless recession call, market top calls etc etc etc and each time they’ve proven worthless.

The economy continue to trudge along….everything else follows from that

“Davidson” submits:

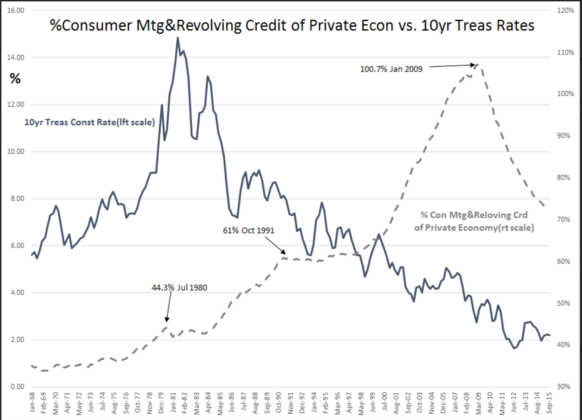

Consumer credit outstanding as a % of the Nominal Private Economy is far lower at 73% Oct 2015 than the peak of 100.7% Jan 2009. Previous levels in consumer credit did not fall as much during past economic corrections as has occurred in our recent experience. Note as well that as 10yr Treasury rates fell, consumers increased their use of credit as lower borrowing costs made it easier to carry additional credit their balance sheets.

Current levels of consumer credit reflect a 10yr Treasury rate of ~7%. In my opinion consumers have been very conservative in their finances and credit as a % of the Nominal Private Economy. As the Nominal Private Economy continues to rise, consumer credit levels as a % continue to fall.

The many concerns about rising consumer debt appear over blown. What many miss is the impact of the 8yr reduction in the Nominal Government Expenditure & Investment impact on Nominal GDP which makes Nominal GDP appear to have slow growth. Make the correction and the Nominal Private Economy looks healthy as does consumer debt use.