“Davidson” submits:

Economic and valuation trends remain as they have since 2009. The US economy continues to expand at a relatively steady pace and job growth remains in a steady uptrend. Job growth is one (but not the only one) of the key indicators reflecting economic expansion. Many adjust their entire economic forecasts on each monthly report which gives the appearance that economic activity starts and stops suddenly making long-term investing a thing of the past. Economic activity is actually far less volatile. It is our imperfect statistical data collection which makes the economy appear volatile. The multi-year charts reflect the choppiness of the data collection and underlines why one must focus on trends and not on single reports.

It is economic activity which drives market psychology and in turn, it is market psychology which drives market prices. There is more than a thousand years of history supporting this relationship. Viewing markets as human systems comes from studying the historical relationship of human behavior in conjunction with economic history and markets. One cannot separate out what we actually do from what we think and how this enters market pricing in a human system. This is the Value Investor approach.

The simplest assessment is to say that today’s pessimism and anticipation that either ‘Brexit’ or terrorism or some other worry will result in a ‘Black Swan’ almost guarantees the market will shift higher in the next few years. A rule of markets is that have never ended without investors finally becoming optimistic. As long as investors are pessimistic, then markets will move higher. This thinking has held the test of time for Value Investors. Even though this is a well grounded observation, one can use economic data to determine that it is economic fundamentals which become eventually reflected in market prices through changes in market psychology. The relationships are summarized in the following:

At the beginning of a cycle: Economic trends turn positive → market psychology turns more optimistic → equity prices rise

At the end of a cycle: Economic trends turn negative → market psychology turns more pessimistic → equity prices fall

Consensus opinion has reversed the role of market psychology. The consensus believes today that market psychology controls the economy and that it is equity prices which control market psychology. This is the reverse of what study of long-term data reveals. That market psychology controls the economy is such a broadly held belief, it is even taught in the best business schools. Value Investors occupy such a minority of investors that I call them “The 1% Solution”. Value Investor perspective on fundamentals leave them as the only group who recognize how economic value creation enters stock pricing over time. Value Investing is not taught anywhere in our educational systems.

The use of logical as opposed to emotional reasoning in our world seems to have diminished. Here is an article worth reading about emotional vs logical reasoning which provides decent color on human perception.

Thinking vs. Feeling – Thinking and Feeling, exploring the differences

Value Investors approach investing logically using long-term relationships because value is only created long-term. Once one adjusts one’s perspective to include multiple economic/investment cycles, the Value Investor approach becomes apparent. Many find this hard to do precisely because peers demand performance from quarter-to-quarter and even week-to-week. Everyone is worried about ‘Risk. The ‘Risk’ they worry about is defined mathematically as ‘fluctuation from the mean over a period’. That period has only become shorter and shorter. ‘Risk’ as the term is used today has no connection to economic value yet it is used as everyone’s measure of how they are doing. Economic value creation is often simply not visible in such short periods. Using market prices which depend on the market psychology of the moment to measure economic value creation is ‘emotional reasoning’. Value Investors use logical reasoning.

Value Investors count on value creation over the long-term, 5yrs-10yrs. They count on other investors to ‘wake up’ or discover value creation once it has made itself apparent for several years. Value creation comes from people. Value creation is eventually reflected in corporate financials. Value Investors focus on the people who know how to create value. This is why Value Investors are deemed early in the investment cycle while consensus investors come in later. Consensus investors are Momentum Investors. They wait till corporate financials have been reflected in price momentum. This is why they are called Momentum Investors. Momentum Investors use emotional reasoning.

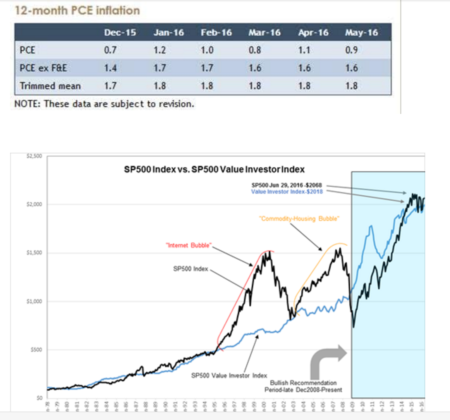

Dallas Fed reports inflation of 1.8%. Vehicle sales remain at high levels. Employment remains on trend. Gallup Job Creation at record highs. SP500 remains fairly valued

The current pessimism provides optimism to Value Investors that equity prices are likely to be higher the next few years. Economic trends remain in expansion and demand for future labor and vehicles continues to remain in force.

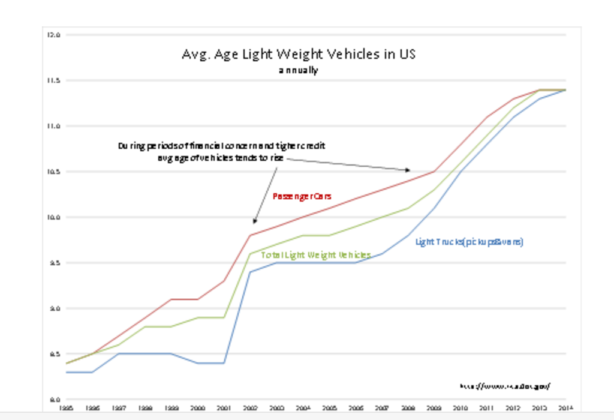

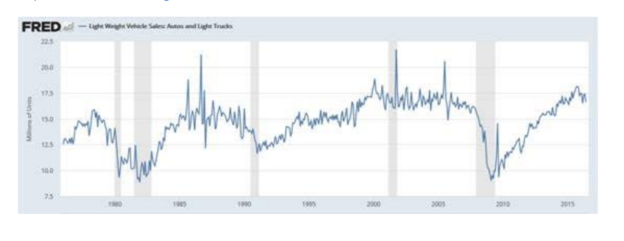

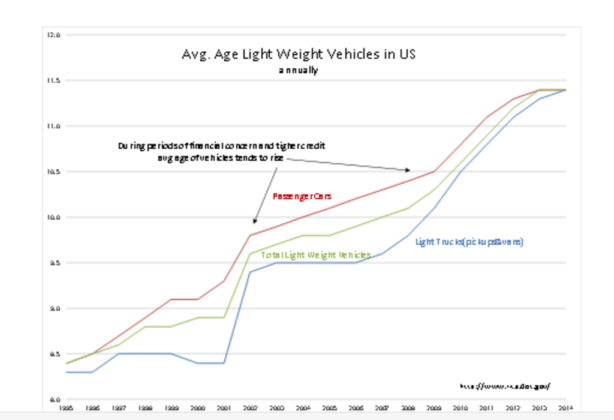

That we are not at peak economic activity can be seen from the long-term chart of US Light Weight Vehicle Sales. We have only recently reached the 17million SAAR level. Past economic cycles typically hold at higher levels for several years. We have been at ~17million SAAR for only 12mos when history indicates 3yrs at this pace is a likely estimate.

https://fred.stlouisfed.org/series/ALTSALES

The age of vehicles on the road is 11.4yrs. and only now are we seeing a flattening of this measure as much older vehicles are being replaced by new. That there has been a general rise in vehicle age is attributable to the higher quality and longer useful lives of vehicles today. Vehicles are more expensive but not only last longer, they also provide substantially better fuel economy, lower service costs, better warranties, better handling and safety features and multiple levels of added technology and convenience.

The latest reports from the Bureau of Labor and Gallup show record demand for labor continues.

The SP500 Value Investor Index(my proprietary indicator based on Wicksell’s ‘Natural Rate’ concept) with a July 2016 level of $2,018 shows little excess valuation in the SP500. Recent market peaks have been accompanied with tops in employment indicators and more than 50% over-pricing of the SP500 relative to the SP500 Value Investor Index. Neither is present today.

Pessimism continues to rule markets. Market tops have always occurred with the consensus turning optimistic. Conditions remain present for higher equity markets the next several years.