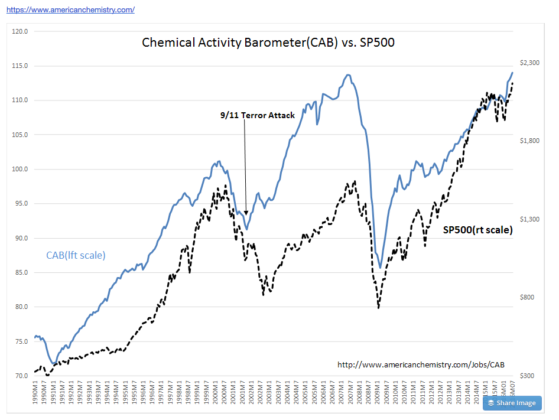

The thesis is pretty simple….chemicals are in everything. If global chemical activity is growing then global GDP is growing then equity markets, which are in no way overvalued, will follow higher.

“Davidson” submits:

The Chemical Activity Barometer(CAB) reached all time record high 114.0 with this week’s report. As a economic indicator which includes production, transportation and hours of operation among other inputs the CAB has shown it captures economic trends from the broad economy. Like many fundamental indicators, the CAB often has periods which disagree with the consensus economic view formed on equity and debt price-trends. Today is one such period. As the CAB has trended higher, a number of high-profile forecasters are calling for an imminent recession. The data here and elsewhere do not support this dire outlook. The data supports accelerating economic activity.

Price trends have traders as a feed-back mechanism. Traders as a group determine investment and economic opinions based on price trends which they are responsible for creating. It becomes a circular and reinforcing argument till enough investors with a fundamental basis believe pricing is too high or too low and do the opposite. At lower levels is it Value Investors who, on seeing the gap narrow between prices and fundamentals, buy equities at levels termed ‘a market low’ or even ‘an intermediate low’. Value Investors buy business values when prices put them on sale.

My recommendation is to continue to remain positive and to add capital to equities.