So I posed the following question to “Davidson” during one of our conversations. “Is the economy growing faster than we think?” ….. “Is the change to a more digital economy causing us to “miss” growth?”

“Davidson”

When people say the modern economy is not captured in the purchase of ‘things’, they misperceive how the economy works. ‘Digital economy’ changes how we acquire information and entertainment. We still pay for all this in paying for $600 smart phones, $100 cable/Internet services which have replaced newspapers, encyclopedias, traveling to movie theatres and etc. The new costs replace the old costs. We get so much, we think it is nearly free, when just like days of old everyone is making profit because they have lowered their delivery costs or have advertising dollars to pay for delivery to us. The consumer is still paying.

The Net/Net is still captured by GDP measures in the value of routers, phones, servers and etc which we now pay for as a monthly svc fee rather than pay for the things they replaced. We do get more for less and are willing to pay for it, otherwise we would simply not pay for it.

Now, that being said, there are two components of GDP, public and private. Davidson points out below that public GDP is contracting and private is accelerating….this is where the perception that “things are better than GDP indicates” comes from.

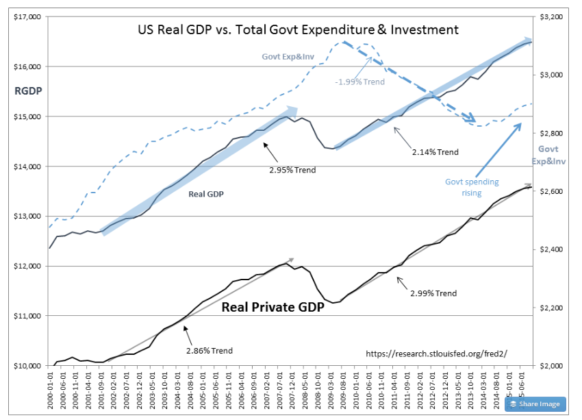

In thinking about the existence of ‘Digital Dark Matter’ it is instructive to look at the details of Real GDP and where the capital comes from. When one does this, Government Expenditure&Investment, the actual spending of government, needs to be separated from transfer payments when thinking of RGDP. Doing this changes one’s perception of where the true productive force exists in our economy how to measure it and analyze it over time. 3 charts tell the story.

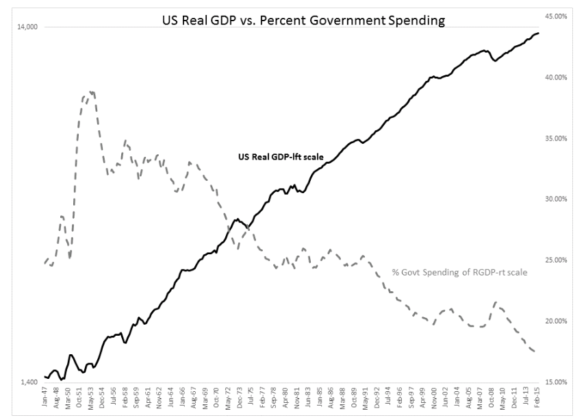

1st-Real Govt Exp&Inv comes from taxation and borrowing capacity of our economy, i.e. we do not tax Govt Exp&Inv to support government programs. But, when we measure RGDP it can inflate or diminish RGDP with changes in Govt Exp&Inv. The history of Govt Exp&Inv shown in the 1st chart shows that it has diminished as a percentage of RGDP over time.

2nd-When Govt Exp&Inv is subtracted out from RGDP one gets Real Private GDP. The perceived slowdown in economic activity as shown in RGDP comes mostly from the decline in Govt Exp&Inv which was due to US withdrawal from Iraq, Afghanistan and general pull back in military spending. The Real Private GDP can be seen to be growing at the same pace as the last recovery.

Net/net, we do not see our true economic activity because we lump Govt Exp&Inv in RGDP and this skews the underlying view of private economic activity on which a society is based.

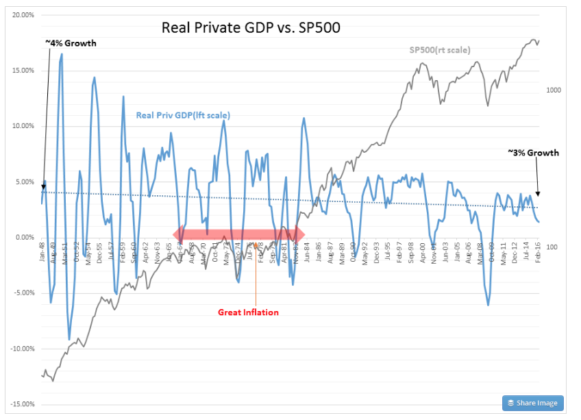

3rd-Look at all the data available and compare Real Private GDP historically to SP500. Real Private GDP growth has been on its long term trend line at ~3%. Even during the “Great Inflation”, when many believed we had ‘Stagflation’, Real Private GDP was in line with its historical trend. It was inflation and government spending which distorted our perception which was the problem as we focused on RGDP and not an adjusted Real Private GDP.

The perception of economic sluggishness comes from only looking at RGDP. It one looks at all data, it quickly becomes clear that RGDP is missing what Real Retail&Food Svc Sales or Real Personal Income are telling us. Record historical Retail Sales and Personal Income do not occur with anemic economic activity.

We have spent so many decades relying on RGDP as the main measure of economic activity that business schools do not teach students to question how we compile the data we use to understand our economy. By reexamining what goes into the economic indicators, one comes away with an intellectually more consistent perspective.

Our economy has become digitized, but we still produce goods and services which are measurable. We have to make sure we know what it is we are measuring.