Davidson and I disagree to an extent on real estate. I think certain sectors are due to fall or flatlining (apartments are overbuilt for example) but I see the sector in general having years of growth ahead of it. The current issue with real estate both residential, retail and commercial (for the most part) is a lack of supply. Lending standards are still over regulated and very tight, supply is limited and well below historical averages and there is still plenty of latent demand. Should credit just normalize we could easily see another surge in housing and the sector in general. I’d not I am not talking about lending “normalizing ” to 2004-06 but to the decades before in which one did not need a 750 credit score to obtain a mortgage (that 750 today is a lot hard to get than it was in 10-15-20 years ago).

“Davidson” submits:

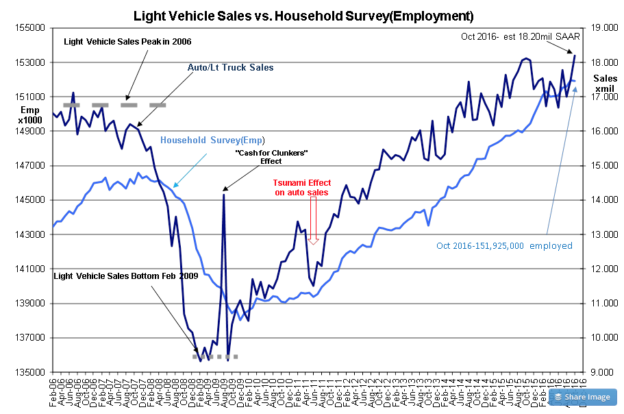

The employment reports indicate the uptrend which began in 2009 continues. The Household Survey report of a dip of 43,000 jobs is simply a minor fluctuation in the series. Light Weight Vehicle Sales hit a cycle high. With average vehicle age over 11yrs+, the current level of sales is likely to continue for several years. Other economic reports such as the Chemical Activity Barometer have shifted to historical high levels and similar levels are present in Real Retail Sales and Real Personal Income. Economic activity is much better than many believe.

It is a fact that when investors are pessimistic they find any chink-in-the-armor of good news to focus on the negative. We had this earlier this week with US oil inventories which ‘soared more than 14mil BBLs’ and caused another bout of oil, energy related and general market weakness. Long term analysis of the US energy market shows that we are in the seasonal change-over to producing winter fuels. During such times refineries must be shut down to change equipment and refining catalysts which results in a surge in inventory as refinery inputs drop nearly 2mill BBL/Day. Over 7 days, having a rise of 14mil BBL in inventory is to be expected and has no connection to the global crude Supply/Demand economics. The pessimists have asserted that we continue to live in a period of an ‘oil glut’ in which companies and countries purposely continue to produce excess oil at levels destructive of their own economic interests. The analysis is based on the belief that weak oil prices are an indication of excess supply. My analysis indicates no ‘oil glut’. My analysis indicates that weak oil prices do not signify weak economic activity, but are in response to changes in the levels of US$. Economic activity is much better than the pessimists comprehend. (The analysis is available on request)

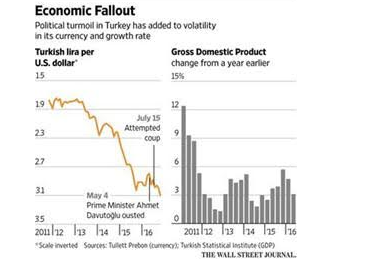

The issue is much larger than the simplistic interpretation of prices as reflecting Supply/Demand economics. The issue sits squarely on the value of the US$ which has strengthened with the rise of terrorism in the world along with a rise in governments seizing personal property. Today’s WSJ has multiple articles about Turkey’s actions earlier this week-see link.

Turkey’s Crackdown Sweeps Through Business and Finance, Imperiling the Economy

Investors who saw Turkey as a free-market beacon fear its president’s focus on rooting out internal enemies endangers financial institutions and trust in its economic stewardship

The fear of property seizure as governments have become more socialist/autocratic globally accelerated to a flood when Russia invaded Ukraine 2014. These governments are not good for economic development or for the standard of living of their citizens. Capital has flooded Western nations and the US from So. America, China, Russia, Turkey and other areas where risk of seizure has risen. The level of the Trade Weighted US$ soared as capital has sought safe havens. The value of the US$ is tied to US foreign policy and has been and remains the ‘elephant in the room’. The beginnings of a reversal are likely with the current election. A change in US foreign policy is likely regardless of which party wins.

My own perception is that investors are so involved with details of weekly and monthly reports coupled with pessimism that they miss the global arena in which each of us should have a focus. Our own economy is far better than many believe. The US is the prime source of increases in the global standard of living. The US is also the only source of support of Democratic institutions which support standard of living increases by support for individual property rights. We are so used to protections of individual property rights we take them for granted and miss seeing how different we are in the world. A strong US$ during turbulent times shows that capital is viewed as being treated better in the US than else where. The US support for Democratic institutions diminished the past few years and the global impact as seen in Turkey this week is the result. The US will be forced to re-engage. This will be a positive for global economic activity. The net result will be a weaker US$ as capital returns to foreign markets.

There are multiple ‘Bubbles’ today. The US$ is highly over-priced -the US 10yr Treasury is highly over-priced-US urban and commercial real estate is highly over-priced. All is due to foreign capital seeking safe havens. The same is true in all Western countries. This situation will be unwound as global capital rebalances with adjustments to US foreign policy.

Value Investors are optimistic that human behavior, if given a chance with support for Democracy, Free Markets and protections for individual property rights, will rebalance themselves naturally. This is my view of global markets today. I continue to be very optimistic and economic trends continue to support this point of view.

Investors should invest portfolios to benefit from unwinding the imbalances present today. Domestic LgCap, Intl LgCap and exposure to those investments which should benefit from a weakening US$ are areas I recommend. The signs of a top in real estate and Fixed Income have been present for some time. My recommendation is that investors avoid these areas.