“Davidson” submits:

US GDP just reported has been met with “Weaker than expected GDP!” There is even despair that the US has entered a permanently slow economy. This pessimism is more about not understanding the components of GDP and the current economy than the economy itself. The economy is much better than many believe.

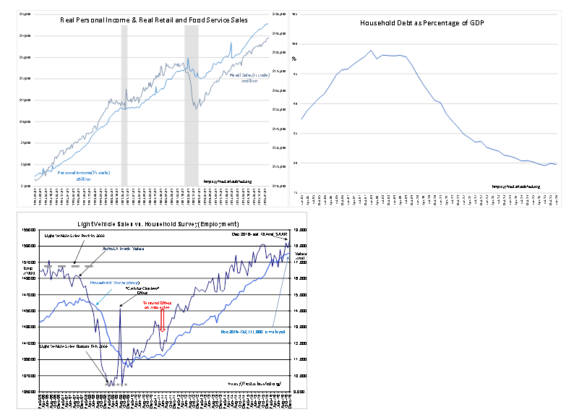

One of the features of our current economic cycle has been persistent pessimism in the face of record Vehicle Sales, record Employment, record Real Personal Income and record Real Retail&Food Svc sales. Clearly Household Debt, a measure of the financial health of Households, has fallen (lower is better) and does not indicate excess borrowing by individuals. With multiple indicators of economic strength, how can GDP remain weak? How should one treat economic data when individual measures so differ from the whole?

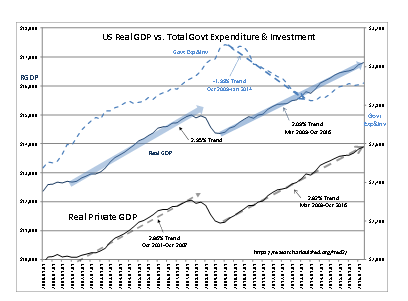

When one is confronted with a body of data in which the sum total indicates something very different than many of its individual components, then one must reexamine in detail the components of whole. When one does this, one discovers that GDP which includes Government Expenditure&Investment (does not include transfer-payments) has impacted GDP independent of underlying Private economic activity. Govt Exp&Inv has long been included in GDP because government spending is part of the consumption of a society’s output. The question is, “Does including Govt Exp&Inv in GDP accurately portray a society’s economic activity?” After all, Govt Exp&Inv is dependent on the underlying economy for support through taxation and the capability to fund borrowing. The issue becomes more acute occurs there are changes in government spending policies which impact GDP and when various component economic measures are not consistent with GDP. This has been the case since March 2009- to date.

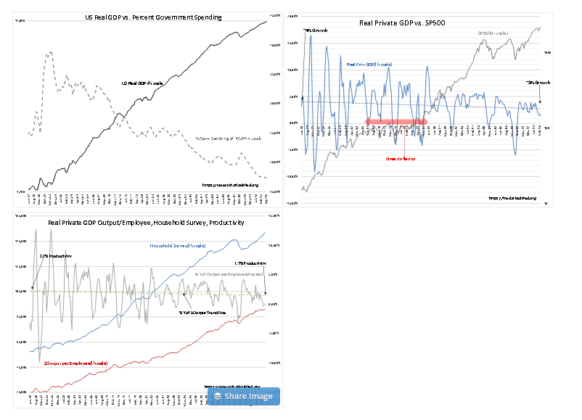

The answer becomes clear when one examines the historical impact Govt Exp&Inv has had on GDP. The chart US Real GDP vs. Percent Government Spending indicates that Govt Exp&Inv wich had been as high as 38% in 1953 has been falling from the WWII and Korean War. There have been periods of government spending increases since for the National Highway System(mid-1950s), Vietnam War-“Great Society”-“Man on the Moon” (mid-1960s), 1990s “Desert Storm”, response to “9/11” and the 2008’sTARP response to the “Sub-Prime Crisis”. One can see that sometimes changes in Govt Exp&Inv was reflected in GDP and other times it was not. Today, Govt Exp&Inv is at the lowest percentage of GDP since Jan 1947 at 17.35%. GDP has long been the ultimate measure of economic activity, but changes in component Govt Exp&Inv, often with borrowed funds skew GDP data resulting in false signals to investors.

It is useful to subtracting Govt. Exp&Inv. from GDP to provide an estimate for the Private GDP. While not a perfect economic measure considering that the Government sector and Private sector have extensive overlap, Private GDP produces a means of understanding the dilemma of GDP not correlating with its components. Real Private GDP vs. SP500 that results has a trend line which indicates that the Real Private GDP has gradually slipped from ~4% in 1948 to just under ~3% today. The US Real Private GDP has never averaged 5%-6%. The GDP growth of 5%-6% levels in the past many have used to compare the current economy came from government spending on top of normal economic activity. By excluding Govt Exp&Inv., the true picture of US economic history becomes apparent.

Note the “Great Inflation” period of the 1970s. The Real Private GDP continued on trend during the 1970s even though many using GDP as an indicator spoke of this as a period of exceptionally slow economic growth. The Real Private GDP reveals this was not the case. The trend line shows the current economy is operating in line with its historical trend.

Taking the Real Private GDP into the Productivity calculation, gives a trend line beginning in 1948 at ~2.2% gradually slipping to ~1.7% today. The Real US economy in 1948 of $1.4Trillion has multiplied 10x to ~$14Trillion. The law of big numbers dictates that big economies do not grow as fast as small ones. Many investors using GDP forecast dismal Productivity levels with some calling for the demise of the US as global financial engine. The Real Private GDP and Productivity appear on or close to their respective long term trends.

The details of the current economic recovery are in US Real GDP vs. Total Govt. Expenditure&Investment. Real GDP appears unusually weak due to a sharp reduction in military spending by the recent administration. Between Oct 2009 and Jan 2014 Real Govt Exp&Inv fell by ~2% annually. The translation to Real GDP had it appear that growth was ~2.1%. In comparison, the Real Private GDP growth has been ~2.9% and in line with the last period of economic expansion. The Real Private GDP is a more accurate portrayal of the record levels in other indicators as discussed above.

In the perspective of Private GDP, all the economic indicators are correlated. This is as they should!. Broad economic activity is never visible in some indicators but not others. One would not see a change in vehicle sales without some accompanying shift in personal income and related employment. GDP was not capturing the economic activity that was obviously present. A significant change in government policy offset growth components in GDP. The Private GDP shows that growth has been for the most part similar to past economic expansions.

Two imbalances remain which have the potential to accelerate economic expansion even more the next several years. Because 10yr Treasury rates have been so low, the rate spread with the T-Bill has been narrow and been detrimental to bank lending. The 10yr Treasury has been at historically low levels, a 5,000yr low in rate levels according to historians. Its rate should be closer to 5% based on the “Natural Rate”. The current widening of the T-Bill/10yr Treasury rate spread stimulates lending which in turn historically accelerates economic activity. The rate spread historically has been 3%+. It has shifted to ~2% today from the July 2016 level of 1.09%. As the 10yr Treasury rate normalizes closer to 5%, the rate spread should continue to widen. The second imbalance is the US$ which has strengthened since 2009 and sharply so since 2014’s Russian invasion of Ukraine. A recession ensued in US energy and industrial related sectors as a result. The normalization of US$ levels should prove an additional boost to US economic expansion.

The next several years appear to offer a positive climate for equity investors.