No matter what your take on the “legalities” of the government’s actions, these documents make it clear, beyond any doubt, that your government lied to you………..repeatedly. It’s no wonder Treasury /FHFA lawyers fought so hard to keep these docs from plaintiffs.

Joshua Rosner has done an amazing job analysing the first batch of documents court ordered to be released from the grip of Treasury in the GSE litigation. It’s kind of depressing. Our government has been blatantly lying to us for over 6 years (and several people listed here did so under oath) when it came to the GSE’s…..

A shareholder suing FHFA/Treasury wrote this on the doc release. (Hindes on doc release (pdf))

Remember:

- FHFA is allegedly an “independent regulator” of the GSE’s answering to no one

- Their goal was to “preserve and protect” the assets of the GSE and return them to the market

- The “conservatorship”, deemed “temporary” by Treasury is now in its 9th year

- Several participants here testified under oath they had no idea the GSE’s would become spectacularly profitable in 2012

The NY Times weighed in today

“Conservator” or “receivership” (the government is acting as receiver while calling it conservatorship)

Alternative 2: Initiate receivership Concept: Ask FHF A to exercise its discretion and place the Enterprises into receivership.

Benefits: If FHF A appoints itself as receiver of one or both Enterprises, then as in the case of conservatorship, FHF A immediately succeeds to all rights and powers of the Enterprise and of all the officers, directors, and stockholders of the Enterprise. 8 But unlike the case with conservatorship, the appointment ofFHFA as receiver automatically terminates all rights and claims that the stockholders and creditors may have against the assets or charter of the Enterprise, except for their right to payment, resolution, or other satisfaction of their claims as determined by FHFA as receiver.

Additionally, unlike the case with conservatorship, FHFA as receiver would be required to place the Enterprise in liquidation and proceed to realize upon the assets of the Enterprise by sale of the assets or transfer of the assets to a limited-life regulated entity established by FHF A. 10 Considerations: First, in conservatorship the entities are treated as going concerns, and FHF A as conservator is required to preserve assets. In receivership, the entities would be in wind-down, and FHF A as receiver would be looking to sell the assets for as much money as it could.

Additionally, while the definition of the deficiency amount used to calculate draws includes a paragraph about how the deficiency amount is to be calculated even when a GSE is in receivership, it is unclear whether Treasury’s preferred stock would be wiped out in receivership.

FHFA acknowledges that far from being independent, they are:

“We can do it and are prepared to follow Treasury’s lead.”

FHFA is supposed to be an independent regulator of the GSE, by admitting they are “following Treasury’s lead”, they admit they are not independent, a violation of HERA.

Blackrock told the government in August 2008 PRIOR to GSE being placed into conservatorship, even assuming 50% greater loan defaults than the base test the government was using:

… But long-term solvency does not appear endangered – we do not expect Freddie Mac to breach critical capital levels even in stress case

Treasury’s goal the entire time:

In making these changes, Treasury has sought to support three key objectives: (1) Winding down Freddie Mac and Fannie Mae

Also:

These changes are consistent with Treasury’s policy to wind-down the GSEs. Sweeping the GSEs’ ·positive net worth helps ensure that the GSEs will not be able to rebuild capital as they are wound down.

This of course is in direct violation of HERA and the FHFA’s stated objective of preserving and rehabilitating the GSE’s.

Treasury also requires:

Require an annual risk management plan be delivered to Treasury

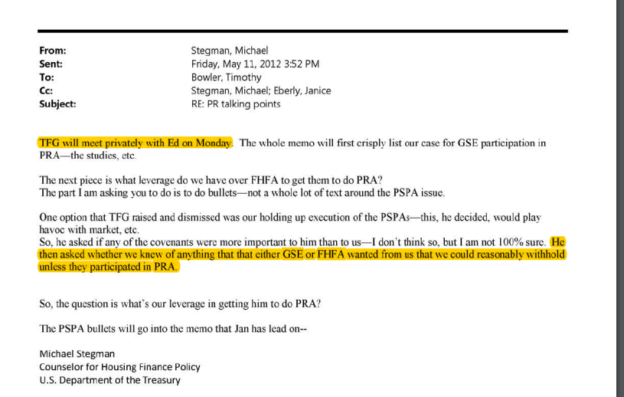

The FHFA is allegedly an “independent regulator” who answers to no one. Look like the answer to Treasury. Another violation of HERA. The email below from Michael Stegman illustrates how Treasury was clearly in the driver seat and internally was asking “what leverage” they had on the FHFA head DeMarco to force him to accept the SPSA (TFG is Timothy F Geithner)

From a Treasury internal document “not intended for public distribution”:

Why aren’t you cutting Fannie and Freddie’s excessively high JO percent dividend rate on the PSPA?

If it weren ‘t for the dividend, those firms would be profitable.

• Treasury remains committed to protecting taxpayers and ensuring that future positive earnings of Fannie Mae and Freddie Mac are returned to taxpayers as compensation for their investment.

Again, no where in HERA does it grant TREASURY the right to make these decisions.