“Davidson” submits:

Equity prices have a long history of rising on positive surprises. Many believe markets to be an ‘efficient’ pricing mechanism of all that is known and unknown. If they believe this, then it is surprising that they are willing to pay more for unexpected positive news.

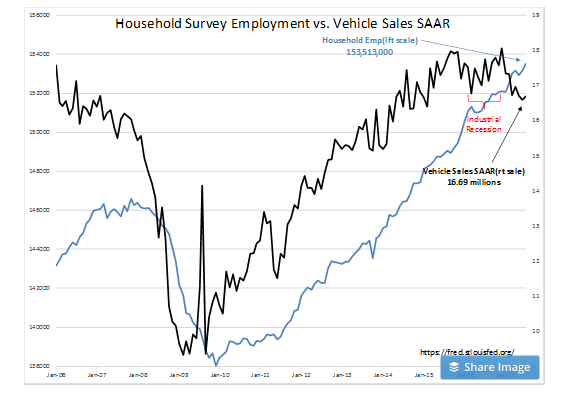

The rise in employment was not expected and markets tend to rise after such a report. The Household Survey was higher by 345,000.

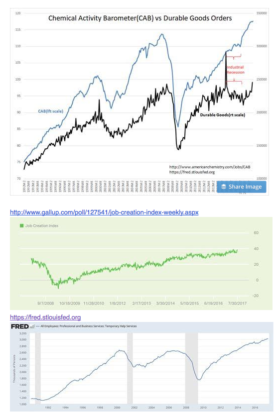

The positive news we have today has its origins ~14mos ago as the US exited an industrial recession caused by the strong US$ impact to high-value exports and commodity prices. US industrial recovery is reflected in the Chemical Activity Barometer(CAB) vs Durable Goods Orders. The CAB reflected improvement earlier with the volatility in the Durable Goods data making it hard to discern a trend till more recently. There is much to like here. Employment trends should be bolstered by improvements in the US Industrial sector as the US$ continues to decline. The Gallup Job Creation Index, not an actual employment measure but a measure of job availability expectations, i.e. market psychology, has been slowly rising through a series of record highs. The Bureau of Labor Statistics Temp Help data which is an actual count of individuals working in temporary positions which routinely lead to full time employment is doing the same. Market psychology of future expectations is the primary driver of market prices. All, media and investors, appear to be shifting towards being more positive.

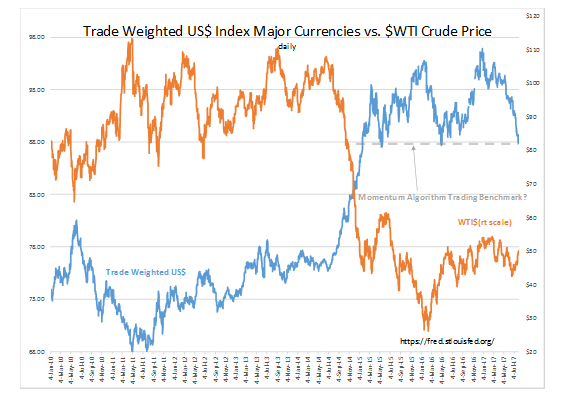

Contributing to the economic environment have been the trends in the US$ and $WTI(West Texas Intermediate Oil Price) the past several years. The US$ and $WTI have been tied inversely by Momentum-Trading algorithms. The strength in the US$ during 2014-2016 resulted in a collapse in $WTI. Many believed the $WTI collapse to be due to excess oil production. The data we have do not support this interpretation, yet this is the consensus view of traders. A change as small as 1mm BBL of 500mm BBL inventory is enough for traders to shift prices by 1%. The sensitivity to small changes in weekly values is surprising when the short-term accuracy of the data is quite poor. The API and EIA data often include less than 90% of the industry and their reports frequently differ by wide margins. At times, these weekly reports differ in opposite directions as much as to 10mm BBL. Market Watch discussed such divergences in 2005.

Whose petroleum data do you trust?

Aug 19, 2005 http://www.marketwatch.com/story/whose-petroleum-supply-data-should-you-trust

Overall, market psychology is mostly determined by changes in the long-term trends with prices shifting through levels considered to be significant benchmarks. Even being a Value Investor requires one to pay attention. The daily pricing of the US$ and $WTI from 2010 to Present indicate one such benchmark may be at hand. It appears that the US$ which has weakened since Dec 2016 may be on the verge of falling through a level which could be significant to Momentum Investors. The US$ remains ‘The Elephant in the Room’ in my opinion. Market psychology tends to accelerate the existing trend when such benchmarks are penetrated. The media has begun to focus on the beneficial impact a weaker US$ has on corporate earnings. I suspect that we are on the verge of improving market psychology for industrial equities and commodity prices. This is likely to be negative for Fixed Income as investors shift capital to capture higher returns.

The US$ remains ‘The Elephant in the Room’.

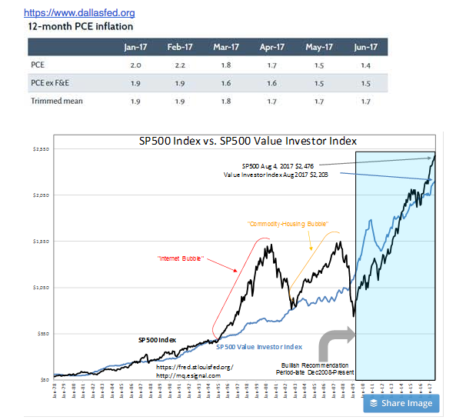

Inflation remains stable at 1.7%. There has been much discussion by the Fed and investors on the need to raise inflation as if this is a signal of economic strength. Historical data shows that inflation is closely aligned to Government Expenditure&Investment and not to employment growth, commodity prices or M2(Money Supply). The Fed has almost no control over inflation as it has had little control over the market forces which impact interest rates. The SP500 Value Investor Index, a fundamental measure which identifies market levels attractive to Value Investors, includes the 12-month PCE Inflation. The current level is $2,203 vs. the SP500 at $2,476. The SP500 carries ~12% premium to the SP500 Value Investor Index. The last 2 market peaks in 2000 and 2007 reflected 100% and ~60% premium levels indicating high levels of investor optimism. Today’s market, even without adjusting for the F.A.N.G. issues which are exceptionally over-priced, does not reflect the levels of investor optimism associated with ‘irrational exuberance’. Most Value Investors will tell you that there are many good investment opportunities available. Many have exposure the US$ and will benefit if the US$ returns to its long-term trend. That trend is ~25% lower than where it is today.

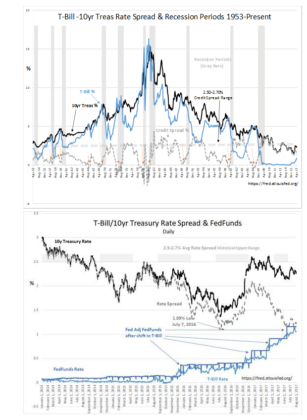

Last but not least is the T-Bill/10yr Treasury rate spread. Economic activity and markets correct every time this rate spread narrows to 0.2% or less. The history from 1953 shows a strong correlation. The narrowing spread occurs as investors seek higher returns. Investors sell T-Bills to buy equities which drives short-term rates so high that they approach the 10yr Treasury rate. The net effect is to slow institutional lending profitability which relies on a wide lending spread. It is safe to say that a narrowing of the T-Bill/10yr Treasury rate spread is a measure of market speculation and investor optimism. Market speculation by narrowing this rate spread effectively creates its own correction. The daily chart from Jan 2014 shows that while T-Bill rates have risen, a spread of 1.20%-1.25% has been maintained. Lending continues to support economic expansion. The rise in T-Bill rates reflects investor improving confidence. We remain well below the economic and market tops for the current cycle.

Summary:

Employment continues to expand with indicators suggesting future expansion as likely. Interest rate spreads are favorable for business expansion and hiring. The US$ weakness favors US exports and expansion in the US industrial sector as well as a rising $WTI favoring the global commodity sector. Markets reflect low levels of speculative excess. Conditions are favorable for higher equity markets.

Markets rise on ‘good news’. The “Efficient Market Theory” by Eugene Fama indicates that markets should have already priced even economic surprises. Investors who believe markets are ‘efficient’ buy more with every media mention as long as it is not ‘bad news’. Markets continue to rise on ‘good news’ till the ‘good news’ stops. Every market cycle has its small group of ‘nifty issues’ which rise on every mention in the media. Investors speak of value, but no price is too high if the news is better than expected. Investors must be aware of this market behavior and not over-guess when a top is likely. The indicators will send a signal when it is time to exit. Economic activity should continue to generate good news for several years. Look for much higher markets ahead.