The price of oil is finally rising….it can go significantly higher

“Davidson” submits:

The US Oil Situation reports from the EIA(US Energy Information Administration) routinely result in sharp shifts in energy prices based on the rise/fall of crude or gasoline inventories versus week-ago levels. For many, this appears a simple relationship, easy to understand and certainly short-term. The US Oil Situation is far less simple when one expands the time horizon to decades, comparing other economic data and adding human behavioral responses to the mix. It is very messy and clearly not so simple, or is it!

The long-term perspective invalidates any short-term interpretations. The data tells a complex story of market psychology, adjustments to wide swings in $WTI, technological discovery/implementation and a pattern of demand driven consumption. A simple connection to oil prices is not found in supply/demand.

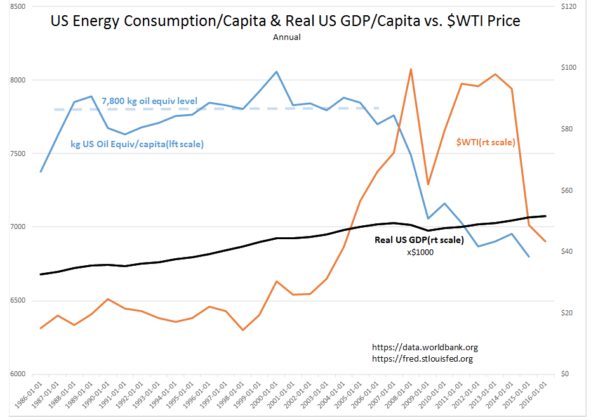

First, as extracted from the World Bank data, US Energy Consumption/Capita & Real US GDP/Capita vs. $WTI Price, US oil consumption plateaued late 1980s at ~7,800 kg oil equiv/capita, then in 2003 $WTI began to rise as the world exited the recession of 2002 and continued rising eventually reaching briefly $140+BBL in 2008. The concept of “Peak Oil” evolved to explain the rise in prices. Human behavioral response met high prices with innovations. Oil/gas exploration firms developed ‘fracking’ to extract energy from previously uneconomic geologic formations. Simultaneously, efficiencies developed with energy use which continues today, 10yrs later. The US currently consumes 6,800 kg oil equiv/capita or is 13% more energy efficient per person while having increased Real GDP per person from $47,000 to $52,000, a 10.6% increase. High energy prices dramatically advanced energy efficiency and drilling technology.

Then in 2014 the US$ surged and commodity prices plummeted and the concept of a perpetual “Oil Glut” took hold. The US responded with a veritable explosion in new drilling technology to lower costs. The US now produces record oil/gas today with less than half the peak rig count in Nov 2011. At the peak in Nov 2011 there were 2026 rigs in use. Today with record US oil/gas production there are only 915 rigs in use. Wells today are producing more with modern drilling/fracking techniques. Current technology permits drilling over 250ft/hr compared to an earlier 25ft/hr pace. Horizontal laterals now stretch out nearly 4miles or 20,000ft vs 2,500ft only 3yrs ago. Low energy prices also dramatically advanced technology.

There are many unpredictable aspects to what has occurred in the US energy story but, it is clear that lower energy consumption per person is not correlated to oil prices.

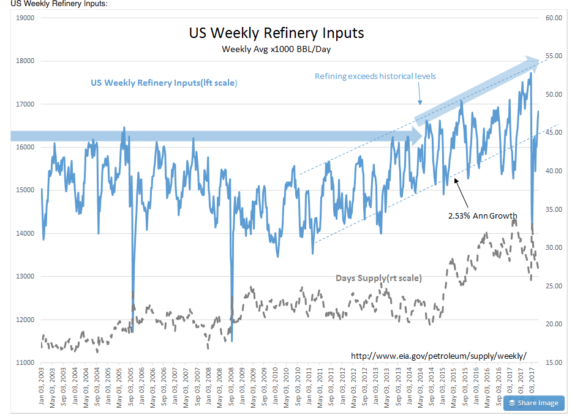

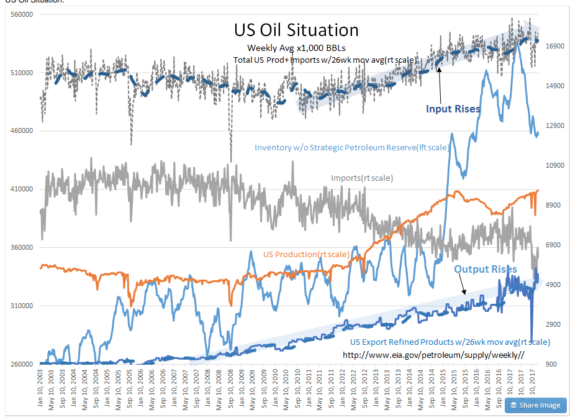

Is there an answer in the EIA data? The US Oil Situation reported by the US Energy Information Administration(EIA) is shown weekly in 4 charts from Jan 2003. The combined impact of efficiencies and a major global recession reduced oil demand into 2009. Lower demand is reflected in lower Refinery Inputs beginning in 2007. Refinery Inputs took till 2014, 7yrs, before we began to exceed that last seen at the peak of economic activity in 2007. The US meanwhile was improving oil/gas production technology and the beginnings of a substantial rise in US Production began in 2011. US Imports began a significant decline.

In 2006, US refiners began to expand exports, US Exports Refined Products. Refined Exports have expanded since without slowing for the 2009 recession. With the $WTI/$Brent price differential, US refiners have relied more on US Oil Production than on Imports for Refinery Input. Since 2006, US Exports Refined Products have risen more than 600% even with needing to supply domestic consumption. US Export Refined Products are at record levels today. To ensure smooth delivery of supply during 2x annual shutdown periods for seasonal maintenance and refining catalyst changes, the US has raised its Inventories to match roughly 30 Days Supply for Refinery Inputs. The argument that inventory was forced into the market by producers dealing with a long-term “Oil Glut” is not supported by the very steady rise in US Exports Refined Products from 2006 and the same for the Total US Production+Imports from 2010. Steady Exports and Inputs reflect demand.

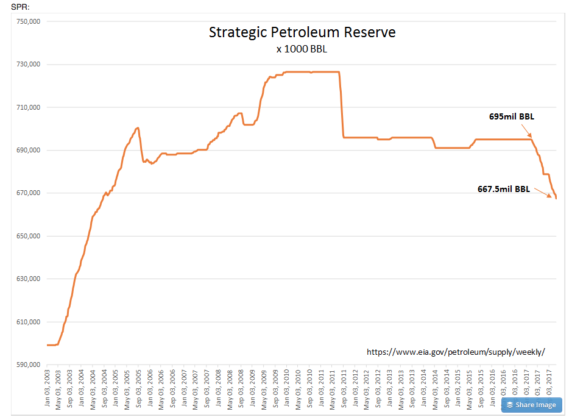

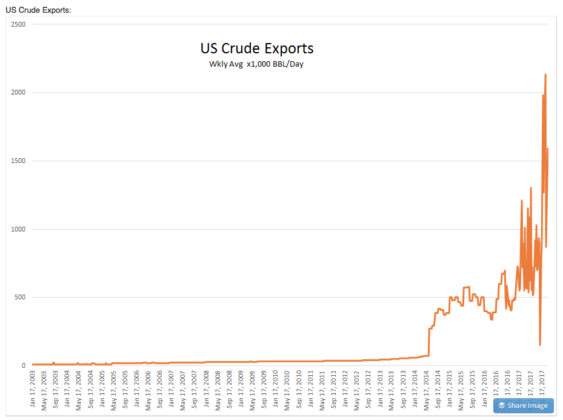

In 2014, Congress permitted crude producers to export for the first time since the Oil Crisis of the 1970s. US Crude Exports have soared from reported levels of 50,000 BBL/Day to nearly 2million BBL/Day. Markets are clearly absorbing this crude. This rule change permits producers to sell to the most cost effective buyer taking into account transportation costs. Net/net the US market has become even more efficient. It should be noted that the current administration has reduced the Strategic Petroleum Reserve since March 2017 by ~30mil BBL. This is 30mil BBL of additional supply and oil prices have risen to the highest level since 2015 as of Nov 22, 2017. This begs the question as to what truly drives energy prices if it is no apparent impact from rising US exports

Global demand as reflected in US Exports Refined Products has continued steadily. The current view that demand does not support oil production, i.e. that there is an “Oil Glut” has no support economically. There is no economic reason to store oil as inventories other than to meet end demand. It costs next to nothing to keep oil in the ground compared to the costs involved in moving it into inventory. Note that during the 2009 recession, when demand clearly fell, the US lowered Refinery Inputs, but oil prices did not fall except briefly as investors panicked March 2009.

A simple connection to oil prices is not found in the EIA supply/demand trends.

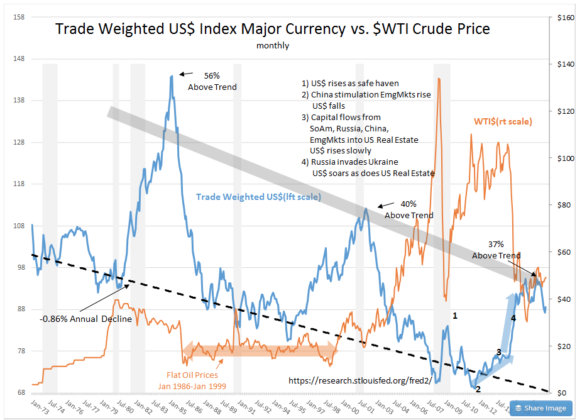

The answer to getting to the heart of the controlling factor in oil prices lies in the relationship which has developed in trading algorithms since 2003. As shown in the EIA data, oil prices seem unconnected to the various supply demand changes witnessed since 2003. The one connection which leaps out is that shown in Trade Weighted US$ Index Major Currency vs. $WTI Crude Price. Since 2003 trading algorithms have relatively tightly correlated changes in the US$ to inverse changes in $WTI. The period 2007 to 2014, the period during which efficiencies lowered the demand for oil/gas and resulted in depressed Refinery Inputs is revealing. This was a period of reduced pace of demand coupled to higher prices. In 2009 there was a notable rise in the US$ as investors panicked globally in response to the “Sub-Prime Crisis” as investors sought safety in safe US based investment vehicles. Correspondingly there was a sharp drop in oil prices which recovered as the US$ retreated. Oil prices continued to rise till July 2011 and stalled in the $95-$100 BBL range when the US$ slowly came off its long-term down trend. Oil prices held at higher levels till 2014 when Russia invaded Ukraine and investors once again fled to US$ assets for safety. Oil prices plunged! Investors believing that prices conveyed an economic message thought falling oil prices meant too much supply, an “Oil Glut”. Further panic ensued driving $WTI to the mid-$20s BBL range Feb 9, 2016.

Since Feb 2016, oil prices have gradually recovered with the US$ retreating. Even with algorithms imparting an inverse correlation between $WTI and US$, this has not been the sole influence. The US Presidential Election caused a sharp rise in the US$ without an inverse shift in oil prices. For the most part, the US$ has been slowly retreating to its long-term trend and $WTI rising. Over the next several years, the US$ should continue towards the long-trend and oil prices should rise. All commodities should rise with a fall in US$ levels.

It seems clear when the data is examined over time that algorithms have connected oil prices(commodity prices) inversely with US$ levels since 2003. There is no guarantee that traders will maintain this relationship, but considering their need to respond quickly to market activity coupled with their exposure to levered positions and futures, it is likely the current inverse correlations will remain for the near term. The US$ has a long-term down-trend which is determined by exportation of low-value but still useful technology and importing those goods manufactured in lower cost countries. Nothing has changed this long-term trend. Investors should expect a decline in the US$ back to trend which should favor companies which have been harmed by US$ strength since 2014. The list of high quality companies which fit this criteria is a long to list, but includes GIS, K, POST, XOM, CAT, KSU and CHD to name a few. A falling US$ favors all high value US export industries.