“Davidson” submits:

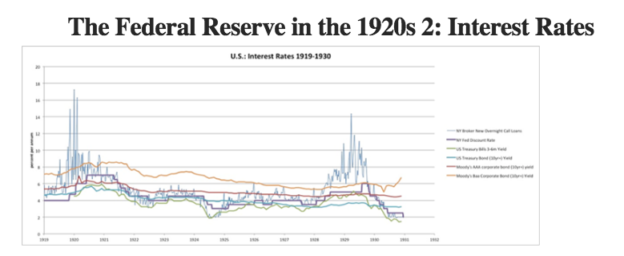

The issue has always been the T-Bill/10yr Treasury rate spread. Same for the worry today about a repeat of the 1929 Crash which many ascribe tariffs. But, it was not about that at all. It was about the financial instability built into the economy since Woodrow Wilson’s 1913 Inaugural Speech about extending lending to farmers, the rural poor. The use of changing underwriting benchmarks to solve poverty was repeated in the our more recent Sub-Prime Crisis. Both, ended with a bang when short-term rates exceeded long-term rates and lending slowed sharply. Bad lending practices suddenly became apparent and investors panicked. Took 16yrs for Wilson’s experiment to cause collapse. It took 13yrs for Sub-Prime and took 16yrs for the damage of the Great Society of the mid-1960s to end in 1982.

The T-Bill/10yr Treas rate spread is 1.25% and mid-range today. All will be fine.

History is chock-a-block full of misperception identification of events as triggers and we miss the underlying conditions. This is why I have read the details of periods of financial corrections to understand what the actual facts indicate. The issue today is not only do we have to separate fact from opinion, but now we have agendas interpreting economic facts in terms of supporting one political party vs another and the confusion has only been compounded.

HTTP://NEWWORLDECONOMICS.COM/THE-FEDERAL-RESERVE-IN-THE-1920S-2-INTEREST-RATES/