“Davidson” submits:

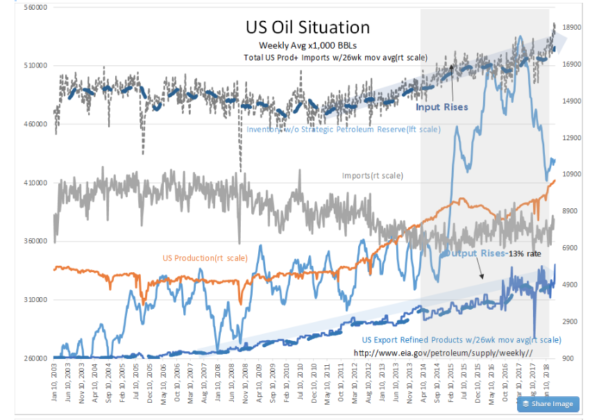

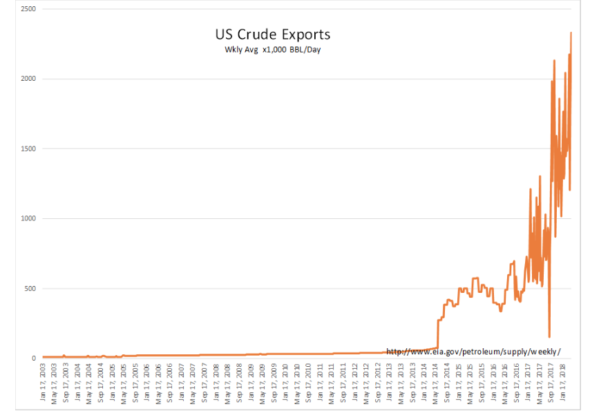

The EIA(US Energy Information Admin) reports indicate record exports of US Crude Exports and US Export Refined Products continue to be achieved. A revealing part of the overall picture is the series Total US Production+ Imports which is also at a record high. This series is a measure of all the Inputs to the US Oil Refining Pipeline. As a measure of US and Global Demand, this trend has been rising uninterrupted since 2009. The collapse in oil prices which many took to mean the presence of an ‘Oil Glut’, which resulted in a temporary decline in US Production due to some well suddenly becoming uneconomic, resulted in a temporary rise in Imports to meet US Export of Refined Products.

Net/net these series indicate that US and Global Demand have been continuously rising. The concept of an ‘Oil Glut’ vs. demand is not present in this data. My opinion that oil price collapse of 2014-2016 rests solely on the sudden strength in the US$(US Dollar) during that period.

US$ strength can be correlated with Russia’s invasion of Crimea and Ukraine coupled with emerging autocratic anti-Democratic elements elsewhere. A return of the US$ to its long-term trend should result in higher oil prices. Some of this has occurred, but more is expected.