“Davidson” submits:

I am suggesting a major shift in portfolios today!

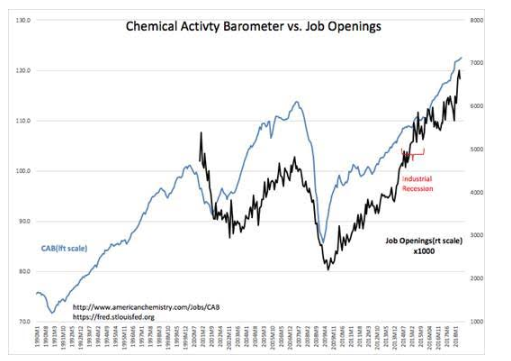

Job Openings reported at 6.638mil, while appearing flat vs. last month’s report saw April’s earlier figure revised from 6.698mil to 6.843mil or 150,000 higher. This indicator’s trend is accelerating which I attribute to recent tax law and deregulation.

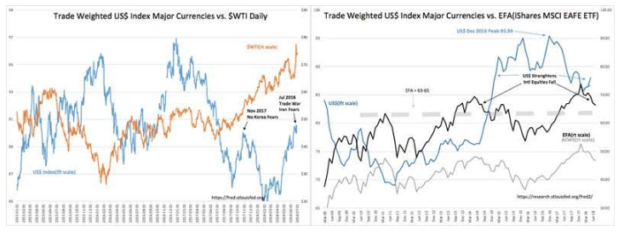

Fewer regulations, lower taxes and policy changes to thwart anti-Democratic forces and lower global tariffs are likely to have significant positive economic stimulus globally even if not all end-points are fully achieved. US markets do not reflect existing or expected levels of economic potential in my opinion. The US economy is likely to out-pace all our trading partners especially if foreign tariffs finally are forced to shift to being more in-line with what they face in the US. Such a readjustment would have benefits to US exports while foreign markets would have to adjust to added competition. In the current confusion, some capital has sought safe-haven in the US forcing the US$ higher.

In my opinion, the policies being implemented by the Administration are likely to have outsized positive effects on the US economy. This has caused a shift in my expectations away from Intl equities favoring US equities.

We should consider shifting more to US away from Intl equities in my opinion. Gradually US policy has shifted to growth while Intl policies remain as they have been the past. The potential for the US has significantly improved on a relative basis. We see some shift to a stronger US$ in recent months as a result. Our Intl holdings shifted lower as a result.

Experience suggests we are in a period of indecision currently. As we come out of this period, I expect to see the rising tide of economic growth in the US hit the headlines and produce higher US equity prices. Eventually, I still expect the US$ to drift lower towards its historical trend representing stronger US creativity/productivity than elsewhere as the US continues to export its standard of living globally.

Net/net US equities likely to outperform Intl equities going forward and likely to be spurred even higher as US$ shifts lower. It is all about improved US productivity vs. other global opportunities. My suggestion is to shift assets to all US/Domestic equities.