“Davidson” submits:

Soybean prices, tariffs? What is the truth to the current media football?

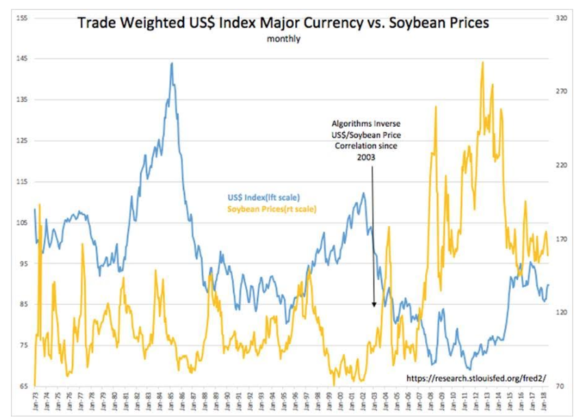

The facts are presented in the Trade Weighted US$ Major Currency vs. Soybean Prices history. From 1973, Soybean prices did not display a significant correlation with currency fluctuations. Starting in 2003 with the inception of computer-driven algorithm trading there is a strong inverse relationship. You will recognize a similar pattern in oi prices. Since 2003 US$ strength has forced commodity prices lower due to algorithmic trading while falling US$ resulted in higher commodity prices.

The recent tariff discussion has not as yet had any unusual impact on soybean prices different from the inverse relationship with the US$ in my opinion. US agricultural industry has experienced weaker pricing since Russia invaded Ukraine and the rise in terrorism and autocratic governments as global investors shifted capital to the US$ assets for safety. While some of this has reversed as the ISIS threat has diminished, the US$ still remains quite elevated vs. its historical trend.

Currently, the focus on recent Soybean price changes ignores the importance of the US$ relationship which remains the most influential for Soybean pricing.

If there is a tariff impact on Soybean prices, it is too small to separated from the normal volatility and inverse US$ correlation.

Don’t believe the media hype!!