“Davidson” submits:

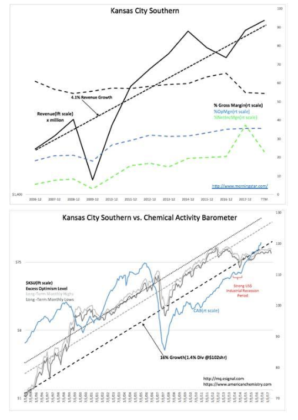

Kansas City Southern(KSU) is a lesson in market psychology. Market prices are set by what investors believe the future will look like with the perspective of current events/widely diverse perceptions. KSU, one of USA’s Class A railroads, just reported record levels of Revenue and business margins. They report a strong business climate and forecasted growth likely to continue in their perspective with strong Mexican cross-border export/import demand. A comparison of KSU’s price history with the Chemical Activity Barometer(CAB) indicates a decidedly unimpressed investor response is present in the current valuation vs. historical valuation. It is this discrepancy between strong and accelerating financial operations and market perception which creates the investment potential.

Market psychology often diverges from business returns. Identifying these situations is what produces investment opportunity, but the investment return is dependent on market psychology turning in the direction which benefits the investment decision. History tells us that investors eventually respond to the underlying returns. The issue for investors is that one may have to wait through a frustrating period of watching business returns evolve as anticipated without markets responding. KSU provides an excellent example of the investment process.

KSU reports record revenue and business margins and the context in which KSU operates as indicated by the CAB, US economic activity, is rising and perhaps accelerating. On a historical basis KSU is well below the typical pricing it has received with current business trends. History suggests KSU could rise to $300shr or higher.

Market psychology has never been predictable in its response to economics and corporate financial history shorter-term.