“Davidson” submits:

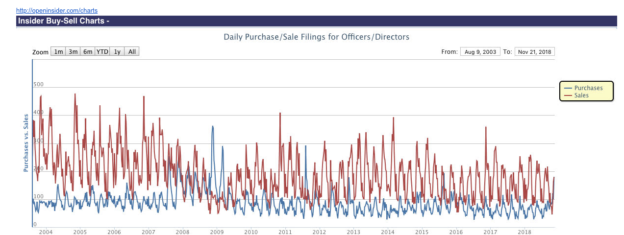

Insider activity is a useful indicator when one compares a company’s price history with the buying/selling option exercises of management. One frequently detects higher levels of share accumulation when prices decline to levels which under-price a company’s future potential. Using this information is enhanced by correlation with a historical pattern of sound financial management and previous share accumulation periods during declines. Many use Buying/Selling patterns, but it is a noted shift towards higher share ownership during low prices which is important. Multiple individual situations build a portfolio over time with each position individually assessed.Periodically, shifts in gross market psychology lower prices enough to produce a general rise in insider buying vs selling indicating a good overall market buying opportunity. We have this today with the recent build in pessimism. In the history from 2004 from Open Insider, 2009 recession pessimism was met with a significant fall in selling and a similar rise in buying as shown by the BLUE LINE. Not as strong a buy signal but still significant was the 2011 market decline. Today’s decline has been met with a spike in buying and is a good signal for investors.

If one is indexing, this is a good time to add capital to one’s equity position. Individual positions require individual assessments. There are many companies with excellent long-term management histories priced low enough to attract higher levels of insider accumulation. So many good opportunities exist today that can easily build a portfolio of 50-100 positions.