“Davidson” submits:

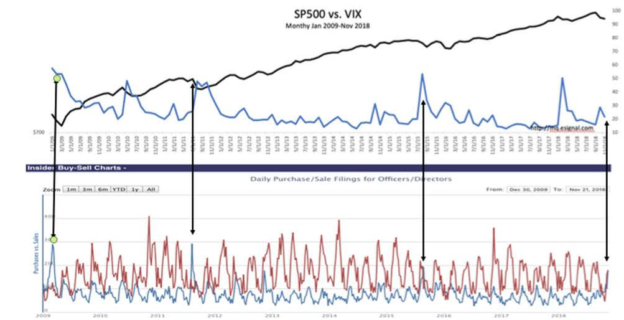

Correlating multiple data series reveals the connections between them that viewing in isolation does not. When the goal is to identify the better buy opportunities for the SP500, spikes in the VIX coupled with spikes in Insider Buying tend to occur together. Since 2009, there have been 4 instances when this data signaled decent buy signals. Note that even though not every spike in the VIX was accompanied with a spike in Insider Buying, spikes in the VIX did identify each near term low in the SP500. Also note that spikes in one data set does not necessarily match spikes in the other.

One must take into account that indices change membership over time gaining a greater share of Momentum issues such as Tesla, Netflix, Facebook, Amazon and etc. Momentum issues which enter the indices as the cycle progresses become responsible for much of periodical price corrections during a cycle tend but rarely have Insider Buying at excessive valuations even after a correction.

Portfolios which carry these names, however, sell portions of every position to reduce market exposure when market sentiment turns negative. Sometimes this lowers valuations enough to stimulate Insider Buying in non-Momentum issues. Investors tend to view markets as cohesive, but just as investors span a Value-to-Momentum spectrum, the range of valuations spans a similar spectrum.

Having a Top-Down perspective is always problematic as most investors miss the detail which provides the greatest insight to making individual portfolio decisions. Studies such as this, reveal that markets are not uniform nor are they as simple as many make them seem. The current environment is a buying opportunity, but specifically which issues or even sectors requires detailed study.