“Davidson” submits:

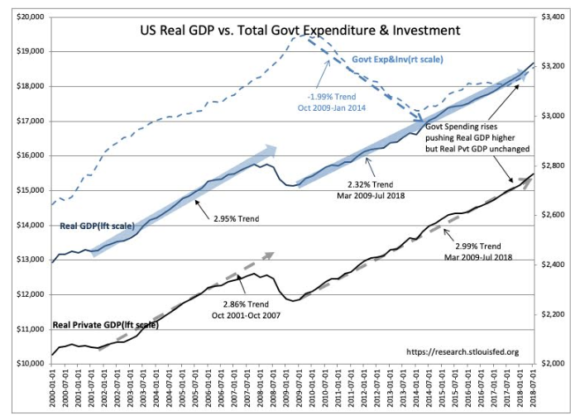

My GDP note of Oct speaks volumes about govt spending. No amount of govt spending has ever boosted the Private GDP. Think of govt spending as forced taxation of the Private economy with the haircut of political decision which are often biased and motivated by self-interest. If one looks at the data, while GDP does rise and fall with spurts in government spending short-term, long term the pace of Real GDP is the same as the Real Private GDP.

I took out govt spending in the current cycle because GDP was lowered by “Sequestration” and I wanted to determine the pace of our economy without it. Lo and behold, the Real Private GDP was shown to have been operating at historical levels since 2009 and in line with employment, CAB and other indicators which reflected normal economic strength while at the same time the media and pundits bemoaned that Real GDP at less than 2%. Not one of them could figure it out.

Such is academic training and those who command stature by it, they think they know all that is needed to be known.

Real GDP rises with increase in Govt Exp&Inv, but Real Private GDP not perceptibly changed. The Real Private GDP has been ~3% March 2009-July 2018. Real Private GDP is the true measure of economic activity and Govt Exp&Inv does not have a long-term impact, but does cause Real GDP to rise with rises in Govt Exp&Inv and to fall with declines in Gov Exp&Inv. By using Real GDP as the measure of economic activity, the consensus is now mistakenly seeing a rise in economic activity when in fact it is mostly decent but unchanged. Govt Exp&Inv helps to drive market psychology higher and equity prices higher when there is no long-term lasting economic benefit.