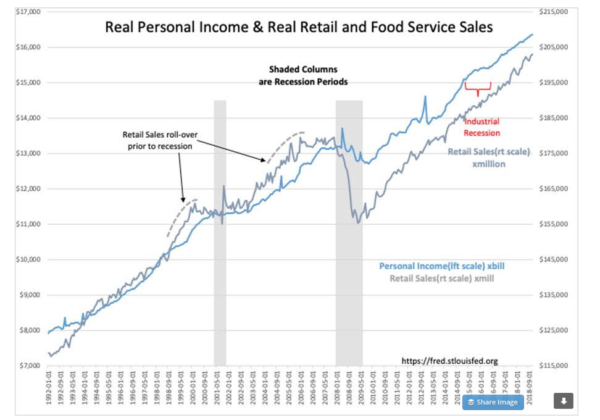

It’s important to note, the economy, not the market indicate recessions. Retail sales, for example are one such indicator. Note from the chart below retail sales tend begin to “roll over” almost year prior to a recession. Now, one indicator is simply not enough but when we combine this with employment trends, chemical activity and other indicators we watch closely here, it is clear a recession is nowhere in our immediate future.

“Davidson” submits:

There are several indicators which provide an early indication of economic peaks. None of them are signaling a peak is at hand. Their history suggests the current market pessimism is a significant ‘Head-Fake’ by those who 1) believe that price trends reveal all that is necessary for predicting economic trends and 2) market cycles have specific timeframes and a top is due. What is missed in the shallow price-trend approach is that Real Retail Sales and Personal Income have to first rollover before we see economic slowing which is then followed by a market top, not the other way around.

The data for Real Retail Sales and Personal Income make it certain that no signs of a rollover is in process. Looks like we should have a good 2019 economically with market prices to follow.

Happy New Year!