“Davidson” submits:

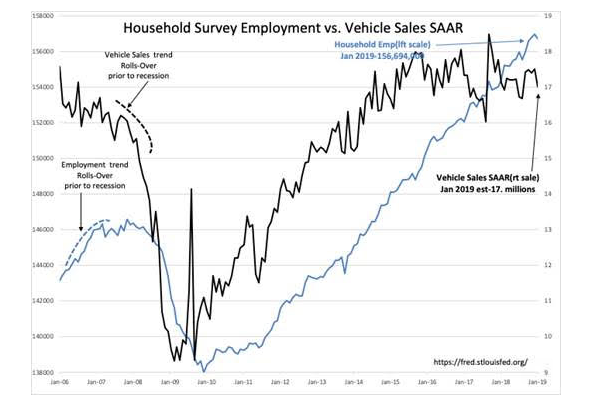

The monthly employment reports always trigger market responses with traders seeking insight to significant turns in existing trends. The Establishment Survey reported a rise of 304,000 with a 90,000 downward revision for Dec 2018. Revisions for previous Establishment Survey reports are routine and mostly ignored by investors who seek to trade on the current report. The Household Survey reported a decline of 251,000 and does not routinely revise previous reports. Neither is better at capturing the overall employment trend vs the other. Both are good measures even though neither is precise. All economic measures are imprecise and require revision as better information becomes available which means that single reports are meaningless measures of current economic activity unless placed in the context of history near-term and long-term. What is surprising is that so many still treat single economic reports as significant when it is the near-term trend within historical context. I prefer the Household Survey which is the only estimate to include the self-employed. Light Weight Vehicle Sales SAAR( Seasonally Adjusted Annual Rate) are estimated at 17mil.

Both, Vehicle Sales and Employment trends slow well before market peaks and inception of recessions. That, there are no signs of either economic series rolling over at this time suggests we likely have at least a couple of years of continued economic expansion. What matters most is the high level of investor pessimism relative to economic and business fundamentals. There is a wide divide between current economic measures and investor perception. It is so wide that historical pricing suggests future SP500 levels could reach higher than $4,000 in a few years should investor pessimism shift to historical levels of optimism. Even though markets have always ended with high levels of optimism, “euphoria” according to John Templeton, prices are dependent on market psychology. Market psychology will always remain unpredictable. The best we can do is to estimate the potential changes in market psychology and its impact.

NOTE: The potential for the SP500 being priced above $4,000 was first suggested 5yrs ago when the SP500 was priced ~$1,600. It startled many at the time, but today no longer appears outlandish.

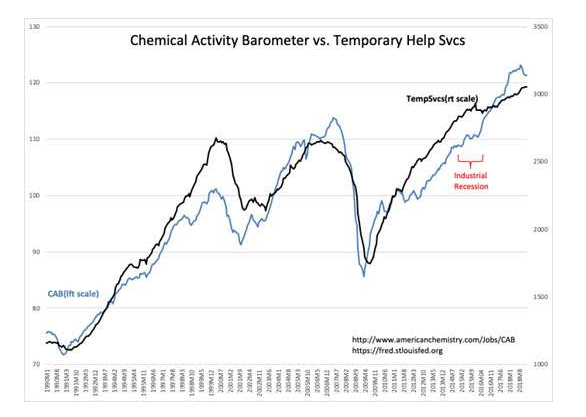

The Chemical Activity Barometer(CAB) and Temporary Help Svcs, which both lead the major employment indicators, have had recent shifts higher. The Temporary Help report, recently revised from Jan 2016 with this report is at record levels and bodes well for future employment expansion which in turn leads to increases in Disposable Personal Income and Retail Sales higher corporate profits and importantly higher equity prices.

The Investment Theme:

All looks good, BUY Equities!