We are up 90% in our DTO short and I fully expect more gains ahead.

“Davidson” submits:

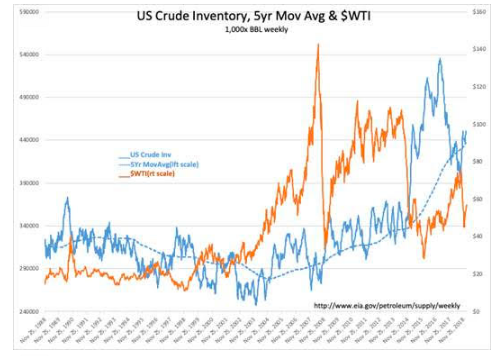

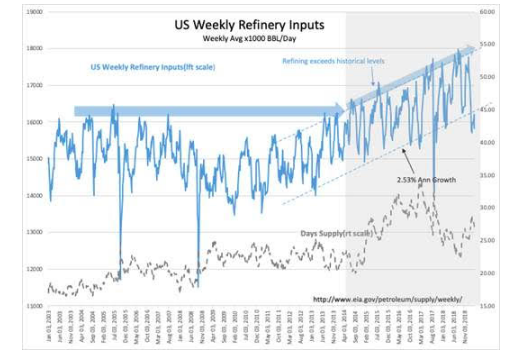

US Crude higher because Refining Inputs fell. Refining input is unusually low, but will recover. When this does, US Crude Inv is likely to fall below 5yr mov avg and $WTI prices go higher.

It is impossible to predict week to week short-term activity in the US energy supply pipeline. But, with a longer perspective one can guess the most likely direction of price using the current US Crude Inventory level vs its 5yr mov avg. The next couple of weeks of prices are likely to be higher.

To subscribe to paid content, for just over $1 a day, click here