“Davidson” submits:

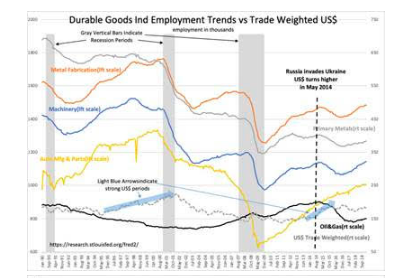

US Manufacturing employment has been in a decent uptrend since early 2017, but its history has not been a simple story. We live in a global business context. There have been significant losses in employment since 1990 due to recessions and periods of strength in the US$(US Dollar) which made it cheaper to shift manufacturing to foreign markets. Countering these periods has been emergence of ‘Lean Processes’ brought to the US by Toyota in the form of the Toyota Business System(TBS) and developed by Danaher called the Danaher Business System(DBS). ‘Lean Mfg’ is an employee engagement process. Employees are actively encouraged, rewarded and trained to provide improvements at all levels of the manufacturing process with the goal of delivering faster, better and cheaper offerings to consumers. Doing more with less makes employees and companies more competitive permitting multiple increases in output with the same or fewer people. The Leaning of manufacturing is a cultural change which now appears sufficiently embedded to counter strong US$ periods.

The most recent inception of a strong US$ occurred with Russia’s invasion of Ukraine in 2014. While US Manufacturing employment exposed to export and commodity markets saw a decline, since early 2017 there has been a decent recovery even in the face of continued US$ strength. The US manufacturing developed by ‘Lean Processes’ remains competitive even with US$ headwinds. Policy initiatives put in place 2017 have supported US competitiveness. Should tariff initiatives result in lower barriers to entry of US goods in foreign markets, US Manufacturing employment is likely to rise. Employment in Auto Mfg&Parts, mostly for domestic consumption, shows little sensitivity to the most recent period of US$ strength, but will also likely benefit with declining tariffs.

The US$ has remained strong since 2014 as Venezuela and Turkey became less friendly to capital and Iran, No Korea, China and Russia issued various threats to their neighbors. The flow of capital seeking safe haven in US$ assets has forced 10yr Treasury rates below that of T-Bills and below FedFunds Rate. The result is an inverted yield curve during a period of strong economic expansion. Past inversions have always occurred with excess equity speculation and not associated with the fear of capital loss we see today.

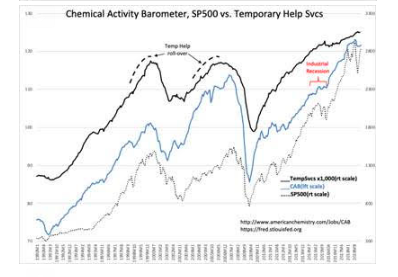

In the past, a very low T-Bill/10yr Treasury rate spreads was a reliable signal for excessive market speculation. Computer trading algorithms are set to respond to this signal triggering sell programs. We experienced this last fall when equity markets fell 20%. Continued economic and corporate reports reversed this pessimism. Continued economic expansion should result in higher equity prices, but algorithms may produce periods of unpredictable volatility.

The economic trends determine market psychology long-term. The Chemical Activity Barometer(CAB) which was impacted by sharp declines in chemical company shares, has turned higher in the latest report. The Temporary Help employment indicator remains in an uptrend. Markets should be higher once this period of global pessimism passes.

To access paid content for just over $1 a day, click here