“Davidson” submits:

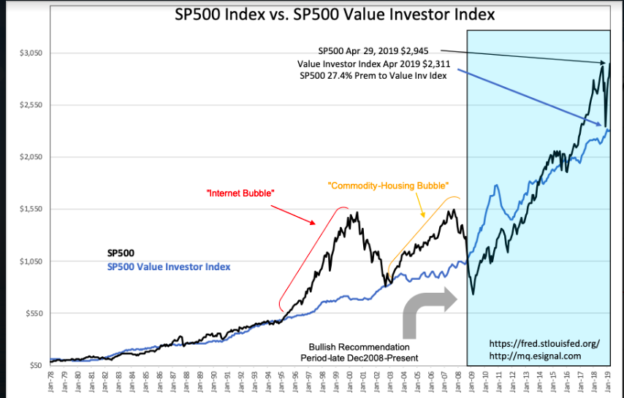

The Dallas Fed 12mo Trimmed Mean PCE reported at 1.96%..slightly revised higher past 2mos. The Natural Rate is 4.90%. This leaves the SP500 27.4% above the Value Investor Index at $2,311.

As stated in prior notes, the Value Investor Index is very good at identifying market buying opportunities when the SP500 falls to within several percentage premium or below this index, but is not overly helpful in identifying major peaks which have been at 65%-100% premium territory.

With current economic fundamentals, it is safe to say, that economic expansion is in progress. How high the market is likely to be priced depends on the length of time market psychology, ‘The Recency Effect’, is given to build towards a period of excess speculation. A peak eventually in the $4,000-$5,000 arena is likely in a few years. The potential for the peak being higher than this range grows with every year of upside earnings surprises. One element to look for is the 10yr Treas driving towards the Natural Rate as investors sell fixed income to buy equities in an attempt to catch missed returns. The term is FOMO, Fear Of Missing Out.

One can only anticipate market tops once we are close to one and excess leverage has builtup in the financial system. That day remains several years in the future. Not today!

To access paid content, please follow this link