Markets do not predict recessions, data does. The data remains positive...

“Davidson” submits:

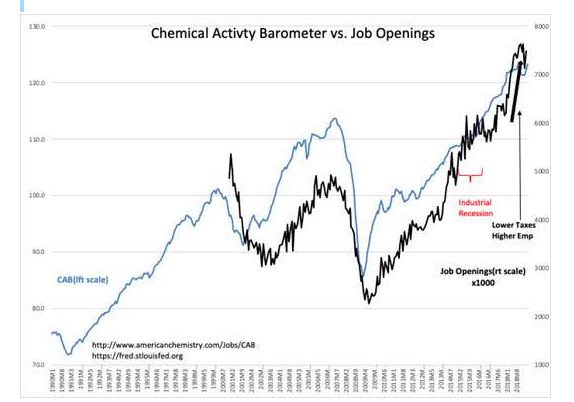

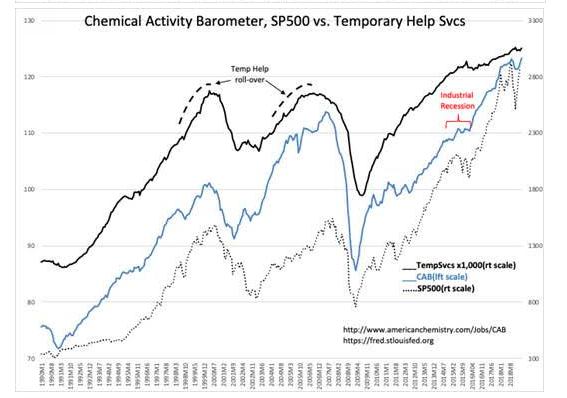

The precursor indicators to higher Employment, higher Personal Income and higher Retail Sales are the forecasting tools for economic activity of Temporary Help, Job Openings and the Chemical Activity Barometer(CAB). Individually any of these reports can have volatility which tends to lead forecasters astray, but collectively their trends have provided decent insights to the direction of future economic activity. Job Openings reported today shows a nice rebound with previous months revised higher.

Despite the general gloom pending an economic peak and market correction, these indicators forecast continued expansion of this cycle. Individual 1Q19 corporate reports and commentaries should counter the current doom and gloom, but, as has been so often the case, investors usually wait till a series of earnings reports have been issued before they push equity prices higher.

I anticipate companies to report better results going forward than investors expect and that equity prices are likely to rise as this occurs.

To access paid content, please follow this link