This is the main reason I like KMI and WMB so much…

Neither KMI or WMB are tied to the price of oil or gas. What they are tied to is the volume transported of both. The more produced, used and exported, the better off both are as they are main sources of transportation of both oil and gas. Whether oil is at $90 or $70 does not matter as long as more of it is being shipped each day. Same for nat gas.

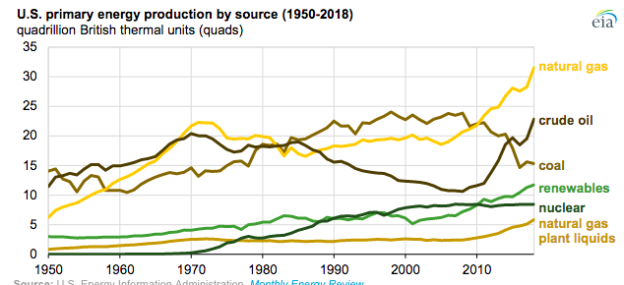

Owning both gives me an >50% market share of all natural gas shipped in the US. As nat gas continues to only grow as the primary energy source n the US, I think that is a good place to be.

Additionally? I get paid over 5% in dividends in both just to hold shares

EIA:

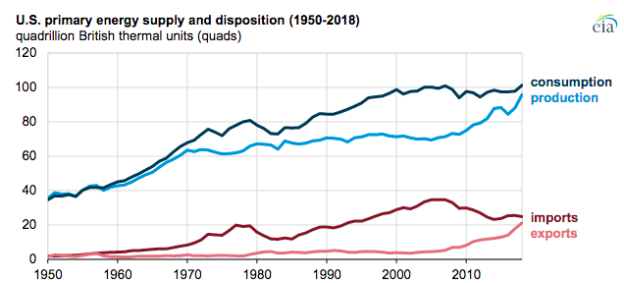

The United States produced a record amount of energy from various sources in 2018, reaching 96 quadrillion British thermal units (quads), an 8% increase from 2017. This increase in production outpaced the 4% increase in U.S. energy consumption, which also reached a record high of 101 quads. At the same time, U.S. energy exports increased 18% to a record high of 21 quads in 2018, reducing net energy imports into the United States to a 54-year low of 4 quads, or less than 4% of U.S. energy consumption.

In 2018, crude oil and natural gas accounted for 57% of all U.S. energy production, with crude oil production seeing an increase of 17% and natural gas an increase of 12% from 2017. Natural gas plant liquids production also increased by 14%. The 17% increase in crude oil production outpaced a modest 2% increase in total domestic petroleum consumption, resulting in a 73% increase in exports of crude oil and a 6% increase in exports of petroleum products in 2018 compared with 2017. Exports of crude oil and petroleum products made up 68% of all U.S. energy exports in 2018.