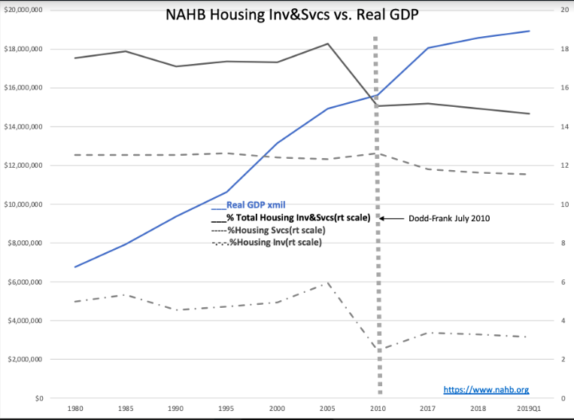

Dodd/Frank has caused the distortions we see in the housing market.

Home building is well below historical measures and that has caused sustained price increases that are pricing new buyers out of the market.

Should it be relaxed, we would see a massive stimulus for the economy…

“Davidson” submits:

This will show up in the next note if MCAI Index rises as expected. NAHB indicates Total Housing impact as 18% Real GDP which dropped due to Dodd-Frank to 14.7% 1Q19

If regs are eased for small banks such that we return to 18% housing impact it will equate to an increase of 3.3%. If only half of this occurs, 1.6%, Real GDP will see $18.9Tril x 0.016 = $302Bil

$302Bill annually for 3yr-5yrs till we catch up to historical housing demand is a lot of extra GDP and capital will flow everywhere.

To access member-only content FREE for 5 days, please follow this link